The Gist (1) Natural gas is now expensive relative to replacement costs. (2) Gassy E&Ps will continue to drive down F&Ds and thus price. (3) Bearish natural gas.

A rule I live by is that supply will always rise and fall to meet demand. Therefore, what matters most is not the balances themselves, but the incremental cost of that supply.

Therefore, we need to ask ourselves: What do gas E&Ps sell their Mcfs for, and perhaps more importantly, what does it cost them to replace those resources?

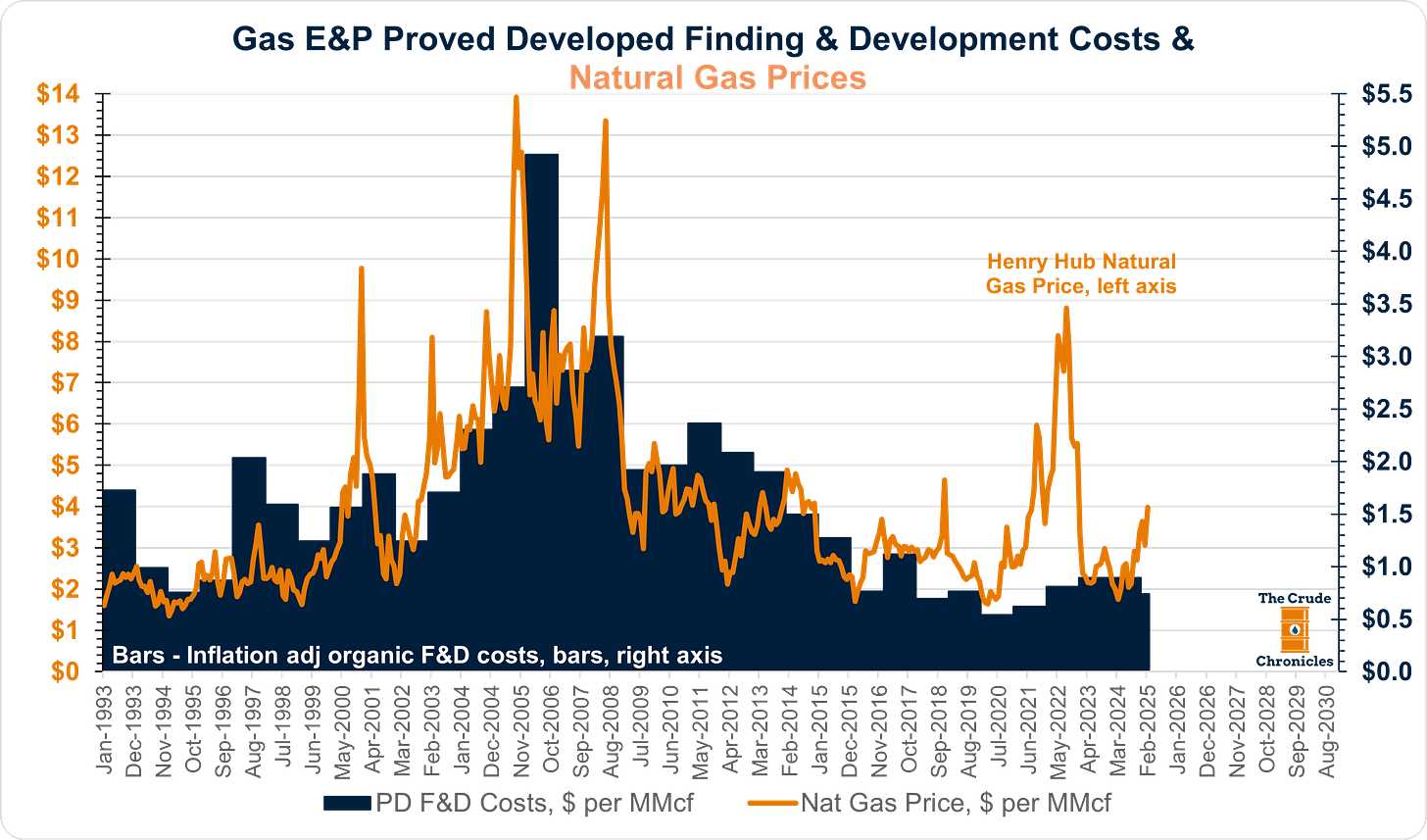

The chart below illustrates this dynamic.

When companies can (1) find increasingly cheaper reserves to produce, they will continue to do so, driving prices lower in the process. (2) When the right incentives are in place, they will accelerate these efforts even further.

Proved Developed (PD) finding and development (F&D) costs are the most concrete measure of how much it costs to bring resources up to production and they are represented by the dark blue bars in the chart.

I compare with the orange line, which represents the price at which natural gas sells at Henry Hub.

Yes, I’m well aware that gas prices trade at a significant discount at Waha. However, the PD F&D bars in the chart represent an aggregation of U.S. pure-play gas E&Ps, whose business models are largely not dependent upon Permian gas prices.

The next chart takes the orange line and divides it by the dark blue bars, showing gas prices relative to PD F&D. This helps answer the question: "What do gassy E&Ps sell their Mcfs for versus what it cost them to replace those volumes?"

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.