The Gist (1) Dollar weakness and emerging market M2 strength is providing support to oil. (2) But to get bullish here we need to see real incomes strengthen meaningfully.

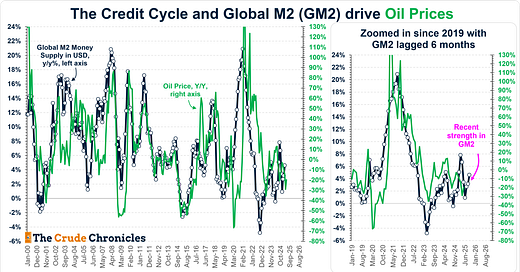

Updating my global money supply (in U.S. dollars) versus oil prices chart gives us a timely signal: there’s a growing case for why oil is bouncing here.

This is particularly interesting given that the consensus remains firmly bearish.

A Quick Refresher on the Framework

Money—and by extension, global credit—is created in one of two ways. Either banks and financial intermediaries extend credit, or governments run larger deficits, effectively “printing” money.

When this happens, it impacts the oil market in two key ways:

It stimulates GDP growth. More money = more demand = increased energy consumption.

It creates monetary inflation. More dollars chasing a finite resource like oil devalues the unit of account—boosting oil prices in dollar terms, even if physical balances don’t change much.

As seen below, we’re witnessing some year-to-date strength in M2 in local currency terms across the major economies. The re-acceleration in China’s M2 is especially notable given its sheer weight in the global monetary base.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.