Hey Chronicle Crew.

This weeks email is short.

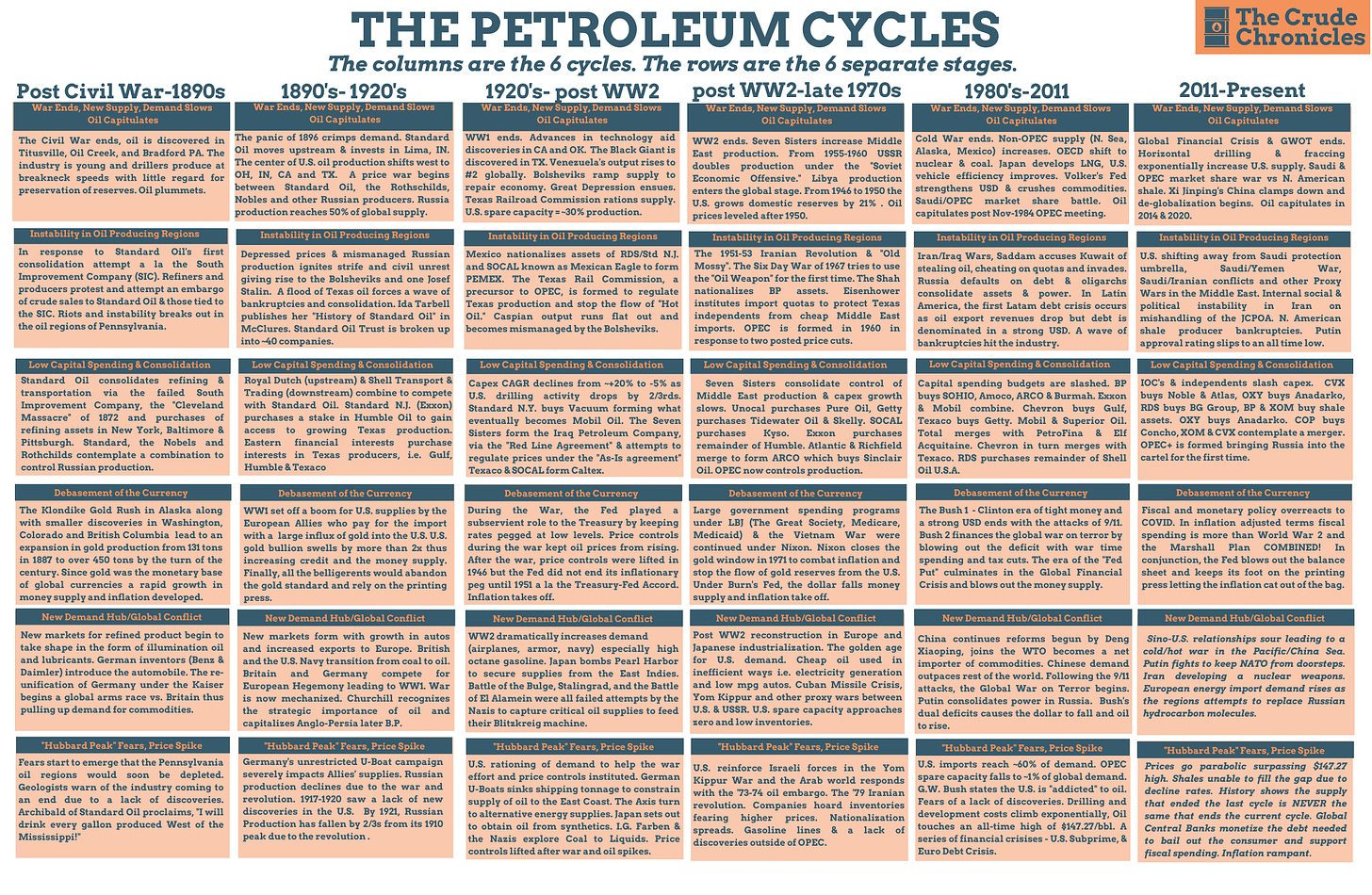

Well sort of, all the content is in the graphic.

If you have followed me on Twitter you may have seen this graphic before.

It is my road map to the petroleum cycles since the beginning of the industry.

Previously I had stated that the cycles move in 5 stages. But I always knew one stage was missing. A very important one.

In order to have an inflationary commodity cycle you need to debase the currency. You need to prime the printing press.

So I updated my road map. There are now 6 stages in my frame work.

The 6 stages are:

Stage 1: War ends, new supply comes online, demand slows and oil capitulates.

Stage 2: There is a period of instability in oil producing regions.

Stage 3: Low capital spending and industry consolidation.

Stage 4: Debasement of the currency

Stage 5: A new demand hub emerges & a global conflict begins.

Stage 6: A “Hubbard Peak” fear of supply running out, prices goes parabolic along with capex

These stages can overlap but in general its my belief they move in this sort of pattern.

I think we have clearly transitioned into stage 5.

Below are the stages (rows) with the parallels in history (columns).

The bottom two right squares are my best guess. Will they be correct? Probably not but I try.

Enjoy.

Now let me ask you for a favor.

If you loved the content, please share

If you like the content, please subscribe

If you have some thoughts/opinions, leave a comment

Or option D, do none of the above and just stay tuned!

Disclaimer

I certify that these are my personal views at the time of this writing. I am not paid or compensated for any of my content. And above all else, this IS NOT an investment newsletter and there is no explicit or implicit financial advice provided here. My views can and will change in the future as warranted by updated analyses and developments. As you may have noticed, I make comments for entertainment purposes as well.

The Crude Chronicler