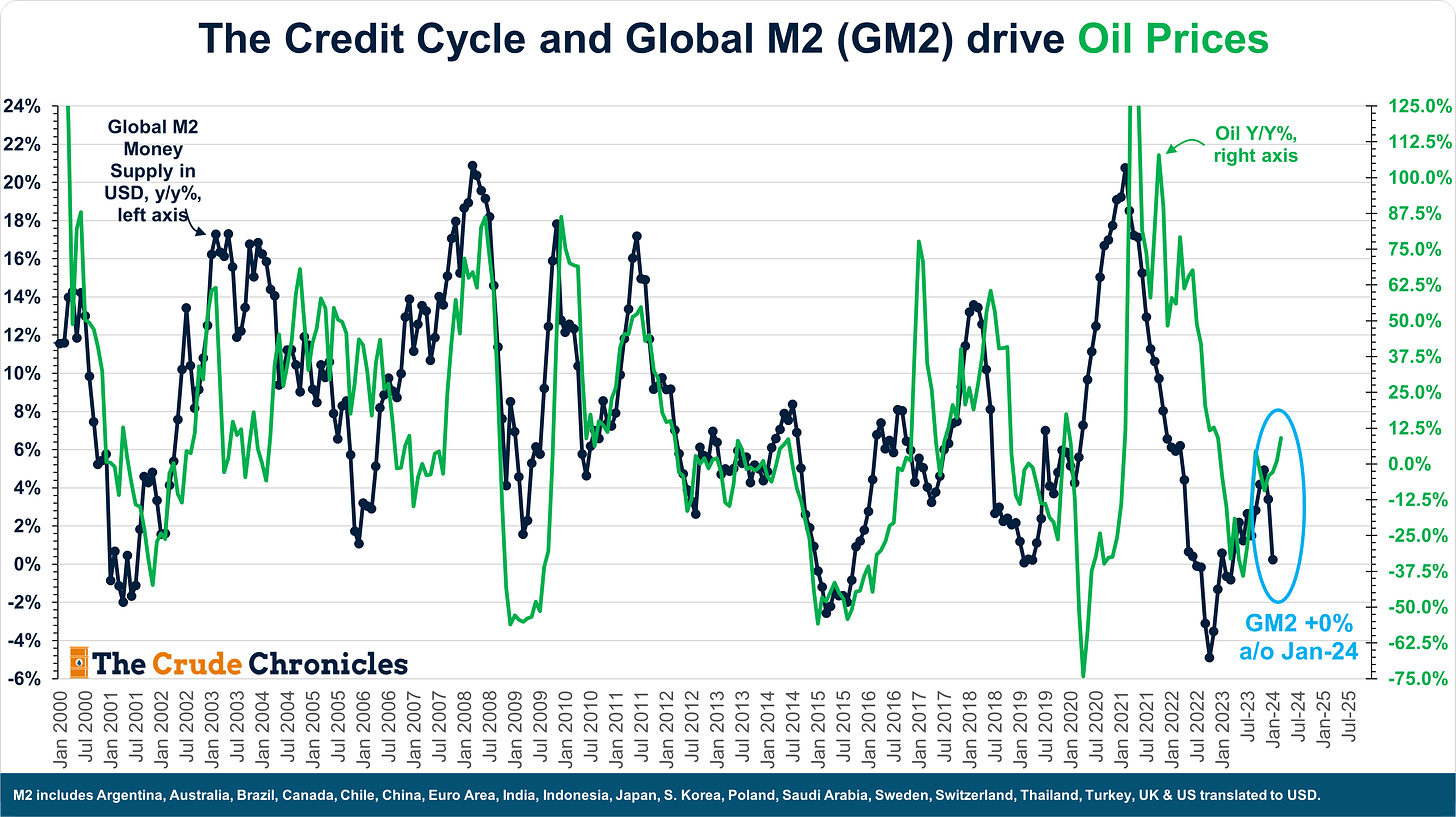

The Gist: (1) Global M2 Money Supply (GM2) just fell out of bed and GM2 leads oil price momentum. (2) The “risk on” sector of oilfield service is NOT participating in the recent strength in oil prices which gives me pause. (3) Real GDP minus 10Y TIPS is signaling refining crack spreads are at risk later this year.(4) Real wage growth drives U.S. oil demand and both private sector wages and particularly the government sector are set to slow while inflation remains sticky. (5) Energy has the most seasonal risk after April. It’s April 2nd…(6) The risk to this view include (a) the optics wherein the O&G sector is late cycle and often beats the market when the Fed is cutting rates. (b) A late cycle recovery in global manufacturing.

The first half of this post hits you with the main points. The second half expands further into each with supplemental charts.

Let’s get into it!

The Main Points

(1) Global M2 Money Supply (GM2) just fell out of bed implying the credit cycle is losing steam. Said another way, “if credit isn’t growing, oil isn’t flowing.”

(2) The “risk on” sector of oilfield service is NOT participating in the recent strength in oil prices which gives me pause.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.