There is a rule in sell-side research - Don’t talk politics.

But that is precisely what we are going to do today.

No, I won’t pitch you some political agenda.

Let's discuss the historical performance of oil and gas equities under different White House and Congressional configurations.

And with last week’s events, the timing couldn’t be better.

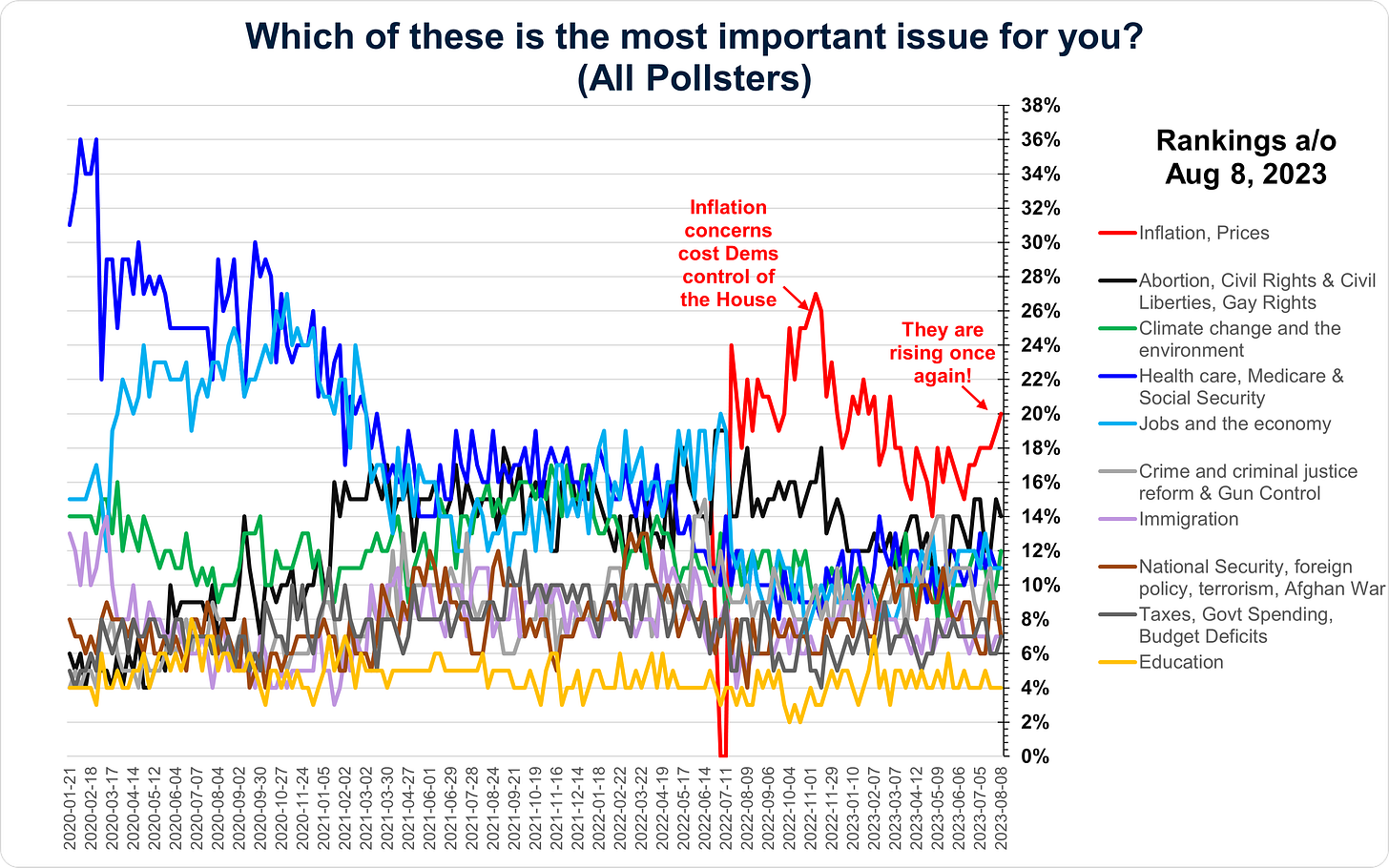

Regardless of which political party is in power, there are two things that incumbents despise. The first is inflation, a significant factor in the Democratic Party losing control of the House during the 2022 midterms. The second is rising unemployment.

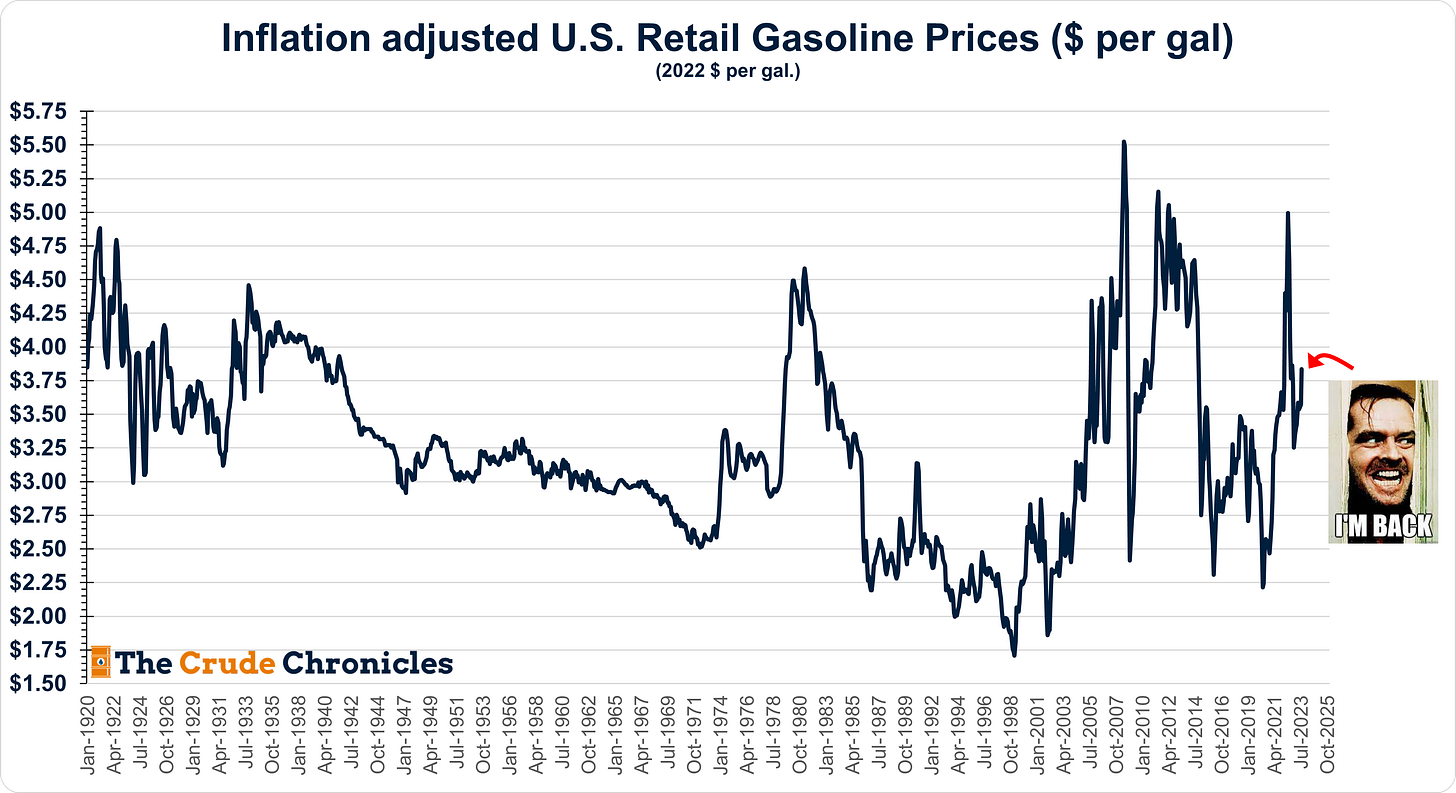

Until recently, retail pump prices had been falling since June 2022 but you know who is back!

So whether or not you agree with it, expect petroleum populism in D.C. to start rearing its little head!

The argument goes that with high energy prices, politicians look to impose an excessive tax on profits.

The retort from industry is that high taxes will disincentive capital spending thus leading to higher prices.

But if you look at history that has not been the case.

Going back to 1925, ExxonMobil’s (formerly Std NJ) capex rates actually rose in a lagged effect to higher taxes as shown below.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.