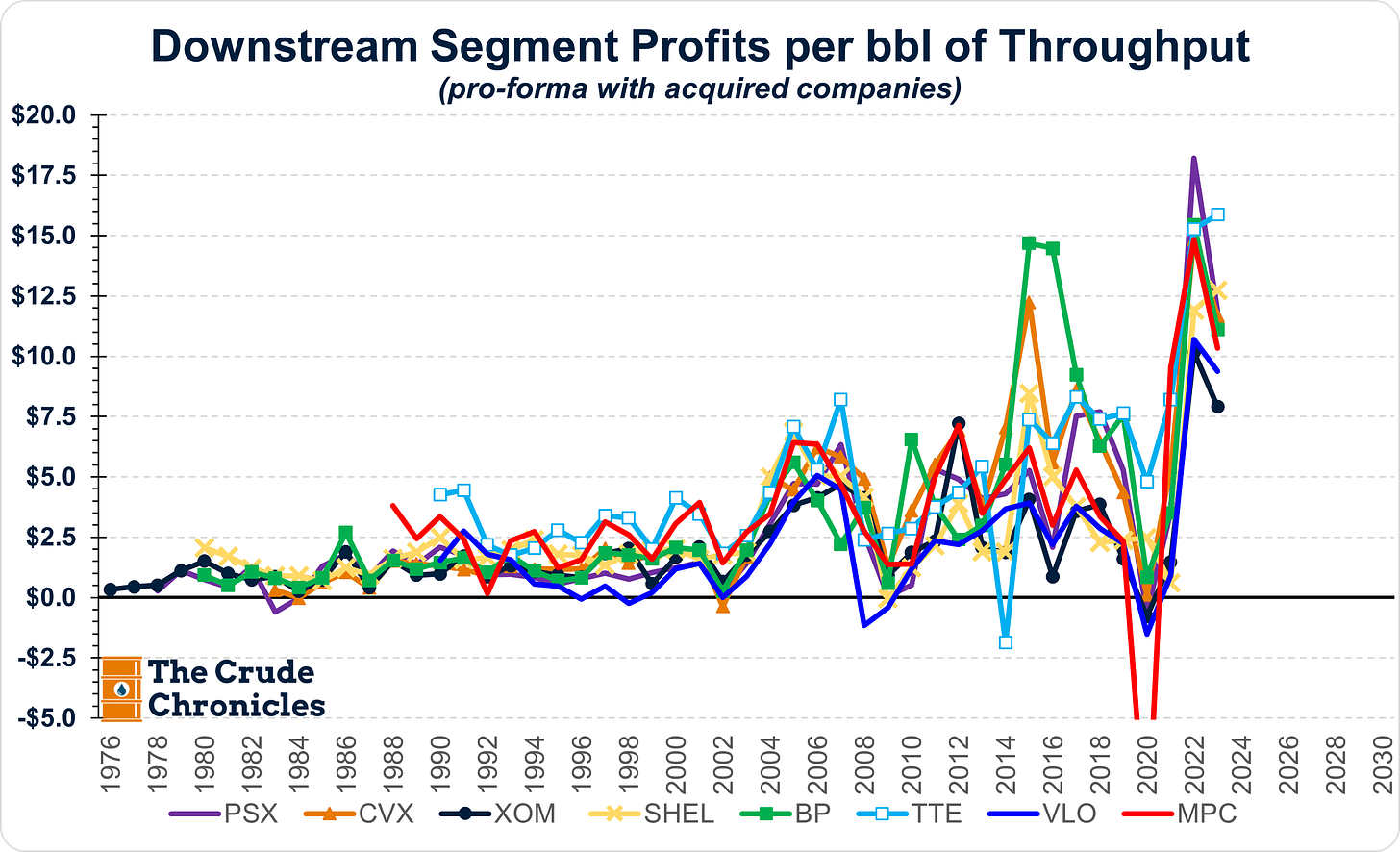

The Gist: The metric of downstream segment profits per barrel of throughput shows that 2022 may have been the peak of this cycle. However, we haven’t had a really good refining/downstream capex cycle since the 2000s and most likely won’t get one. So expect downstream profits per barrel to continue to show higher highs the next go around.

Many of us spend our days examining the world of refining through the lens of crack spreads, utilization, and various product inventories.

However, another way to gauge where we are in the refining cycle is to examine how much in profits the companies make from each barrel of crude oil they process.

The result is below. (See note at the bottom)

The chart is updated through 3Q23 with the latest period annualized.

The chart draws the conclusion that refining profits ber barrel peaked in 2022.

Using PPI for fuels and products as a deflator to adjust for inflation, one gets the following chart to compare refining profitability through various economic cycles.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.