If you have ever seen the Ice Age movies you probably know of the character, Scrat.

Scrat is a hybrid of a sabertooth squirrel that spends his days looking for food or in his case acorns.

Every time he gets his hands on his beloved acorn something happens to poor Scrat that causes him to plummet to his death, become crushed by a foreign object, and a host of other uncomfortable endings.

But Scrat always comes back!

That’s exactly how energy folks have felt for the last 15 years.

Every time things get going something happens.

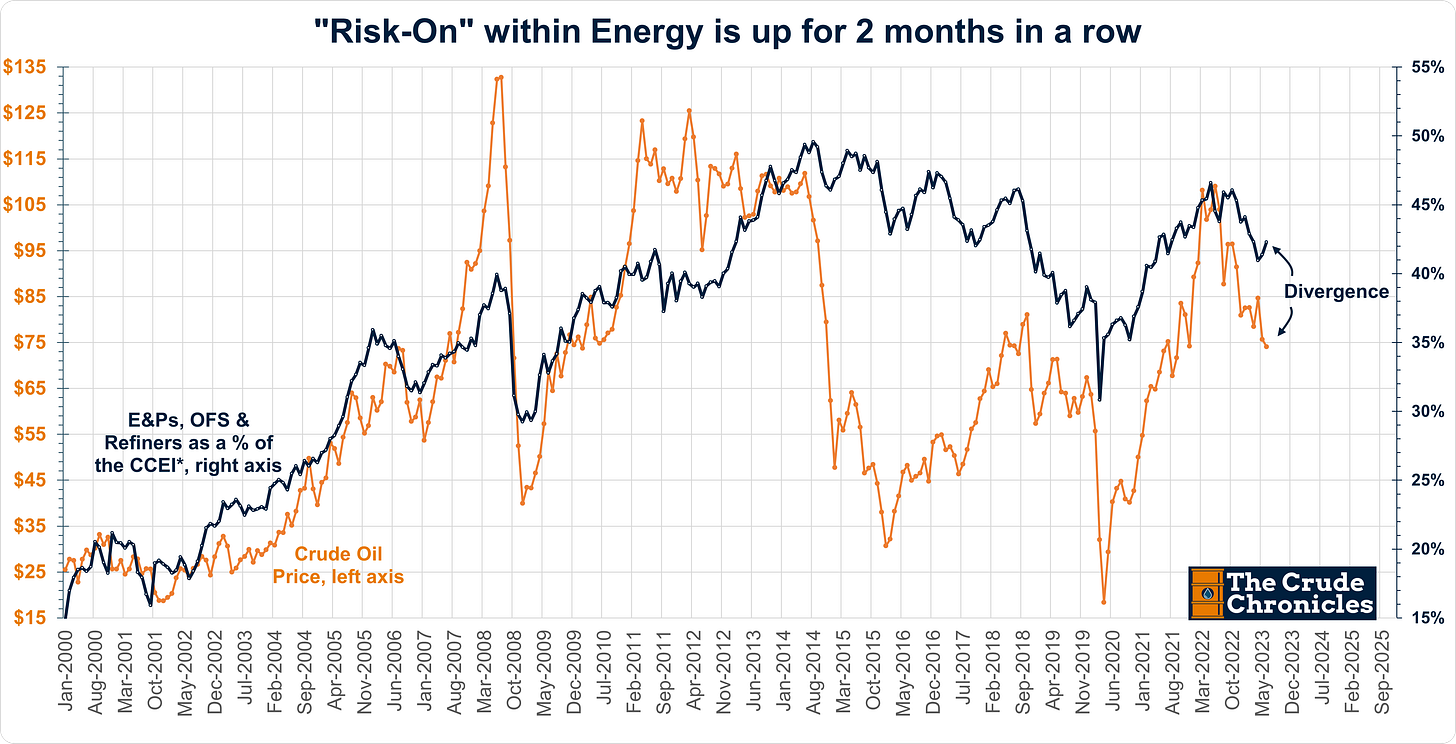

At the end of May, I started to notice something that was occurring for a couple of days in a row. The “risk-on” sectors within oil & gas started getting some life.

Those sectors constitute E&Ps, oilfield service & equipment, drillers, and refiners.

Integrated oils are essentially “risk-off.” I would assume midstream MLPs are too but I don’t have the data/charts to back that up.

Below is how a chart of how the relationship looked back in May, risk-on was rising but crude had not yet turned.

Every day I look to see which O&G sub-sectors are up and which are down.

Since those summer lows, risk-on has been winning.

But something has been occurring of late.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.