Natural gas is like the classic high school counselor joke—the one about someone with "endless potential." It always seems to be on the verge of something big.

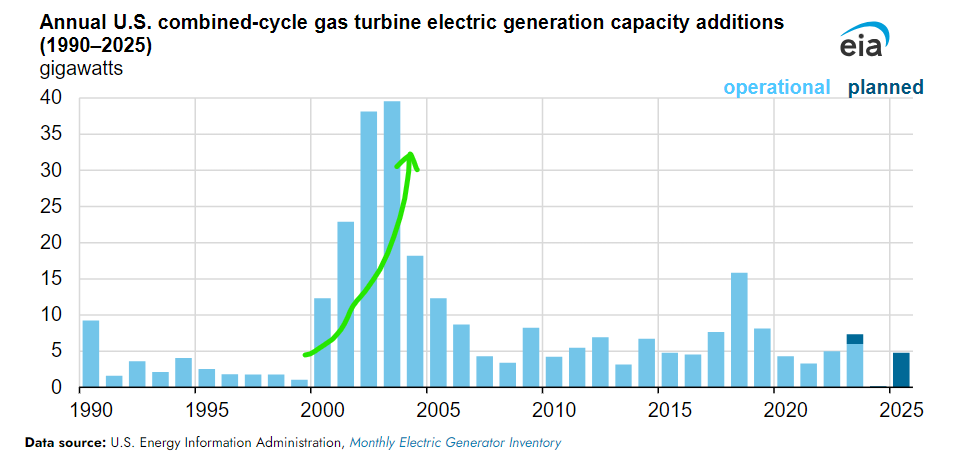

When I set out to prove my high school counselor wrong and began a career in energy investing, natural gas was poised for a growth surge. This was driven largely by independent power producers (IPPs) that embraced gas-fired plants after the deregulation of natural gas markets.

Note the units in the above chart is gigawatts (GW) not megawatts (MW). Think of 1 GW as 1 nuclear power plant. And while gas-fired plants don’t have the same utilization factors as nuclear, building the equivalent generating capacity of 40 nuclear power plants in one year is mind blowing, even for China.

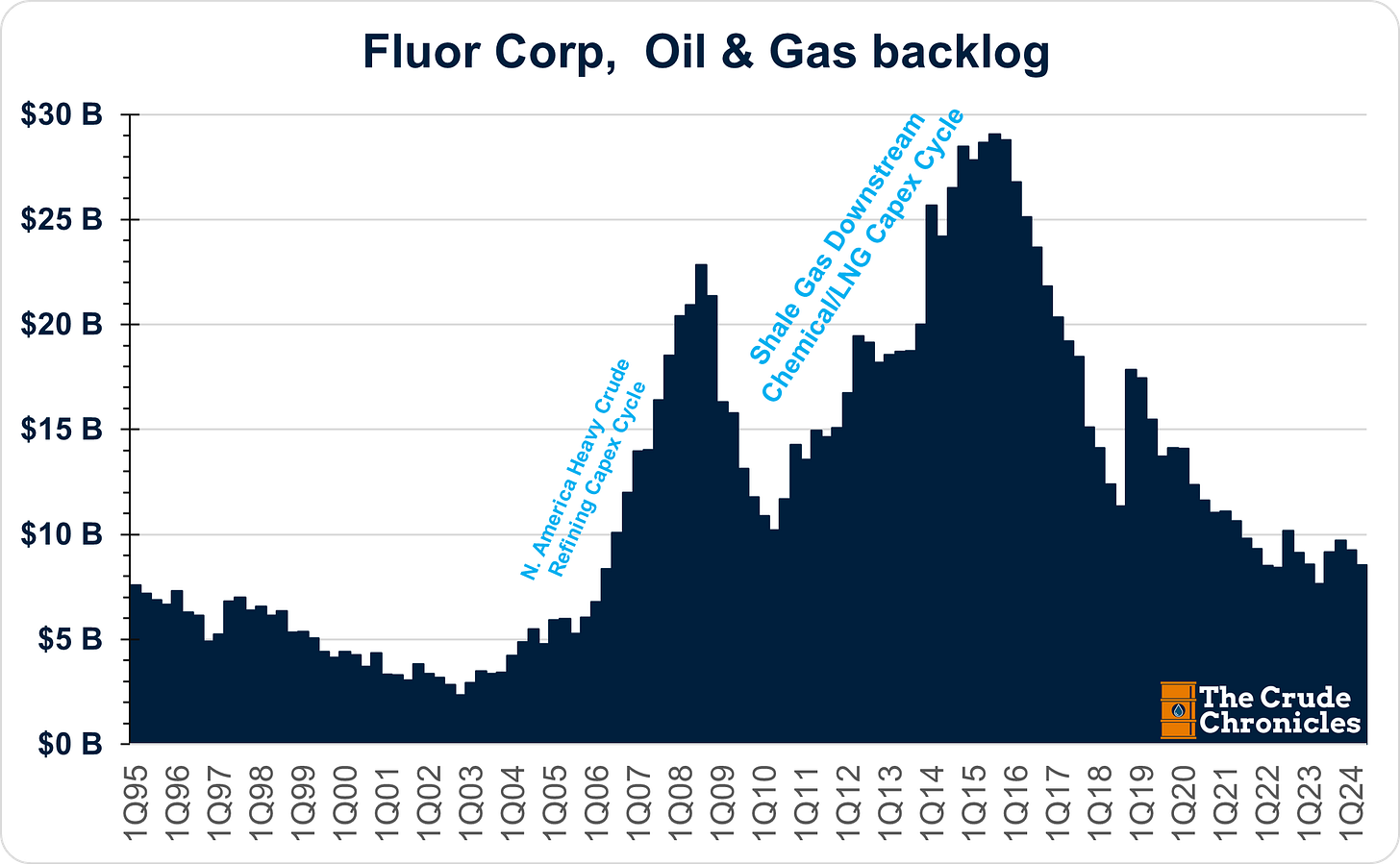

After the shale revolution natural gas became so cheap that the world’s chemical manufacturers decided to build out their base load ethylene capacity and my former Engineering & Construction coverage group saw their backlogs balloon!

Yet natural gas prices remained “cheap.”

The next investment theme centered around U.S. LNG plants, aiming to export cheap U.S. gas to global markets and narrow the price gap between Henry Hub and international price benchmarks in Asia and Europe.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.