(1) Commodities need a cheapened/devalued currency. (2) A narrative developed that oil is positively correlated with the dollar due to the U.S. being a net exporter and the largest oil and gas producer in the world. However, I see this as more symptomatic of a late-cycle effect. (3) The inverse relationship of the dollar and oil may have just re-establish itself.

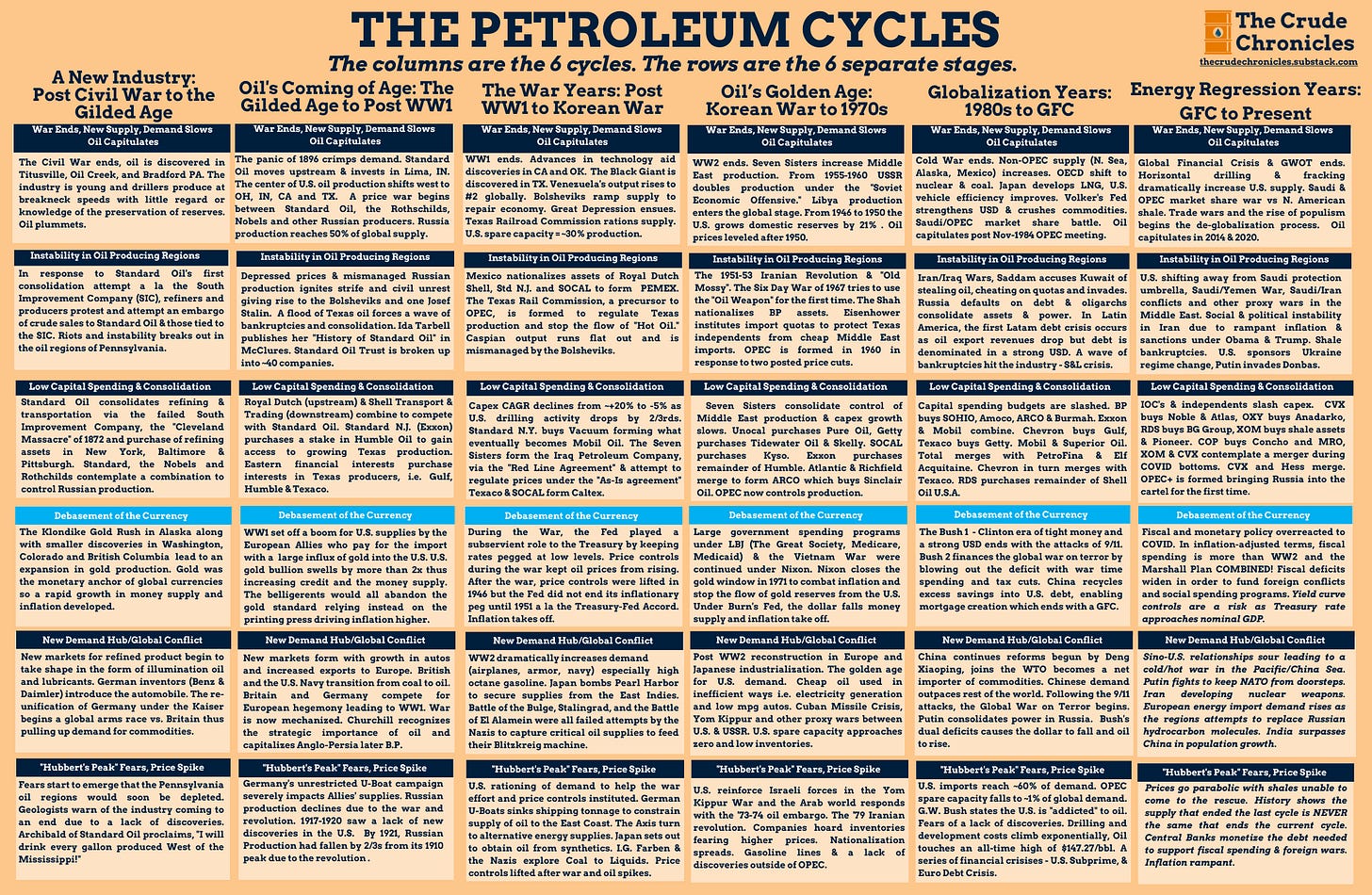

As illustrated in row 4 of each column below, a defining feature of every cycle is the debasement of the prevailing global currency, whether it be the U.S. dollar or, in earlier eras, shiny metals.

When speculation arose that the dollar and oil are now positively correlated due to the U.S. petroleum trade balance driven by shale production, I became highly skeptical as a student of history.

The petroleum trade, which once accounted for nearly half of all U.S. goods and services trade, is now relatively insignificant compared to the broader range of goods and services Americans import from abroad.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.