The O&G Cycles - Free Post!

What’s up everyone?

I told you I would be away on vacay this week but I couldn’t help myself.

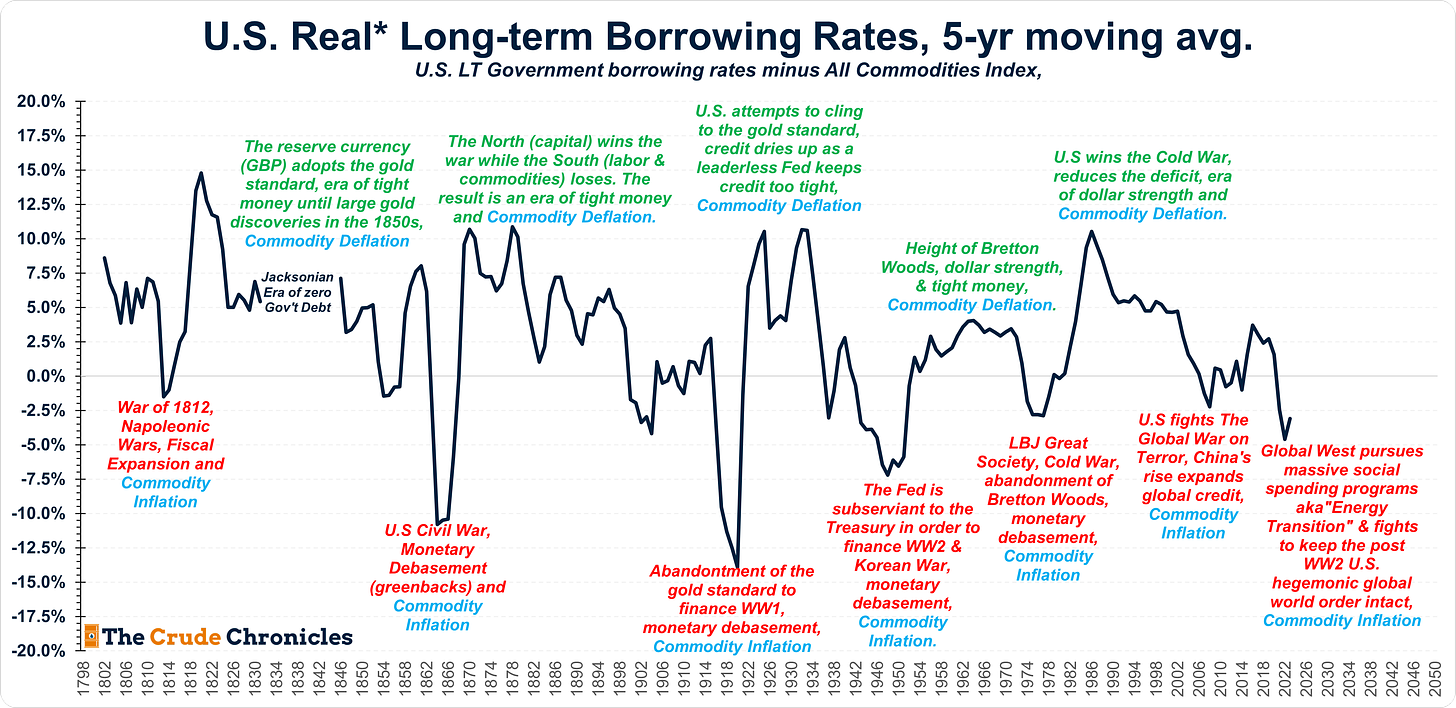

History is nothing more than someone’s interpretation of events and the following graphic is my interpretation of the cycles for the petroleum industry.

Each column represents a separate cycle while each row represents one of the 6 stages that are repeated within each cycle.

The 6 stages are

A war ends, new supply comes online & oil prices capitulate.

Instability develops in oil producing regions.

A period of low capital spending coupled with industry consolidation.

Debasement of the currency.

A new demand center emerges and/or a global conflict erupts.

And finally prices rise in a parabolic fashion on the fear over lack of supply or what I term "Hubbert's Peak Fear"

This table keeps me grounded in trying to answer the question, “where are we in the cycle.”

If you want a pdf version of it click below.

I think we are exiting stage 3 (third row - Low Capital Spending & Consolidation) and entering stage 4 - Debasement of the Currency.

The important thing to note, is there can be some of stage 3 while we are in stage 4 as well has hints of stage 5.

What has never happened in this industry is the skipping of a stage such as going from stage 3 back to stage 1.

One thing you may notice is I haven’t yet added the recent slate of M&A to the latest stage 3 as most of the marquee deals haven’t closed yet.

The italicized text in the bottom right of the above table are my forecasts.

At present the median voter could care less about government spending level and budget deficits as evidenced using polling data from Yougov (HERE).

The absence of the political will to reduce spending and adopt a tighter fiscal policy, suggests to me that the path of least resistance forward is to continue with the status quo of outsized fiscal policies to fund social spending programs including wars, both proxy and possibly hot wars down the road.

The other metric I rely on heavily to answer the question of where we are in the cycle is oil divided by the S&P 500 as evidenced below.

But to get an update on that things will have to wait till I get back with an updated. To get the full update, subscribe below.

I’m currently in Cancun, Mexico with the wife and kids.

See you all when I get back!

-Rob Connors, CFA, CPA, Commodity Cycle Observer in Cancun