The Gist: XOM’s acquisition of PXD has ramifications for the entire industry. Not only could they potentially re-achieve a share of U.S. oil production that they haven’t seen since the days of Standard Oil but according to my friends at FLOW (HERE) this deal has significance for how we will view the Permian and the capital intensity cycle as a whole.

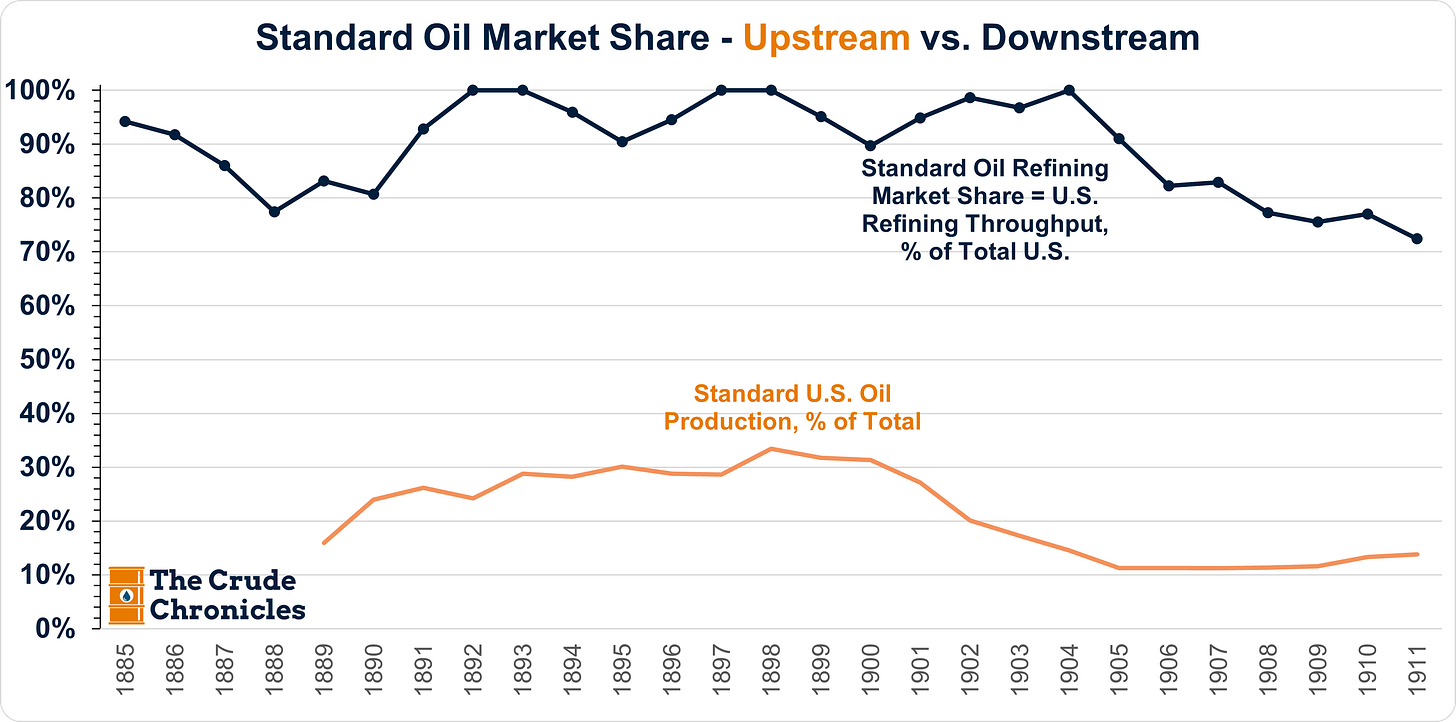

Numerous experts in the field of oil history are aware that Standard Oil's ascent can be attributed to its control over the downstream refining and transportation systems.

A big reason they were able to control the downstream was that both production and demand centers were focused around the eastern part of the country. Standard controlled the middle part of that equation - the connection between the wellhead and the customer.

However, by the late 19th century, U.S. oil production was shifting west.

First to Ohio, then to California, and finally to Oklahoma and Texas.

Standard Oil would begin to lose its grip on the industry and with the break up its share of U.S. oil production.

Looking back at the history of Standard Oil & ExxonMobil and adding on Pioneer we get a chart that looks like this, XOM reconstructed U.S. oil production since 1889.

Immediately, one’s eye is drawn to the upper right-hand corner and that 2027 Permain target of 2 million bbl/d that the company has laid out.

If one assumes that U.S. production continues to grow at ~3% through 2027, that 2mil bbl/d target would put XOM’s share of U.S. production at 14.6%.

It would put them just a hair above the 1972 high of 14.4% and flirt with the market share they had back in the days of John D. Rockefeller.

A remarkable comeback not only for XOM but for the U.S.

The point to draw here is not just a historical comparison but rather XOM’s strategy matters A LOT not just for the Permian but for incremental global oil production and the capex cycle.

One could easily conclude that to reach that 2 mil bbl/d target it would require the need to ramp capex.

Can, and more importantly, will they do that?

My friends at FLOW and Tom Loughrey (HERE) think otherwise. According to them and I am paraphrasing:

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.