The Gist: Consensus estimates suggest 2-2.5% growth in U.S. oil production in 2025. I believe growth will be 0% at best. We use a new tool from DoTadda Knowledge to analyze what companies have been saying.

Quick question, with 4Q on the horizon, what do you need to get up to speed on?

Do you want to know what E&Ps have been saying about 2025 production growth?

What are the oilfield service names saying about margin trends?

What’s the latest on integrateds’ capital allocation decisions?

What’s the latest on refining margins?

Are offshore day rates headed higher?

How is recent M&A going and who is getting the most synergies?

Please reply with your questions—not because I have the answers; I don’t.

My former buyside counterpart and all-around great guy, Andrew Meister, has developed a very cool SaaS tool called DoTadda Knowledge (HERE) that uses AI/LLM to scrape transcripts for the summaries and answers you need, saving all of us time in an affordable way. At the bottom of this post (below the paywall), there's a video highlighting DoTadda’s capabilities. Please take a look!

The tool is great for anyone on the sell-side, buy-side, investor relations, corporate roles, media or independent research in any field, not just energy. We are going to use it today to supplement some of my research.

I have a view that U.S. production will surprise to the downside in 2025. Here is why:

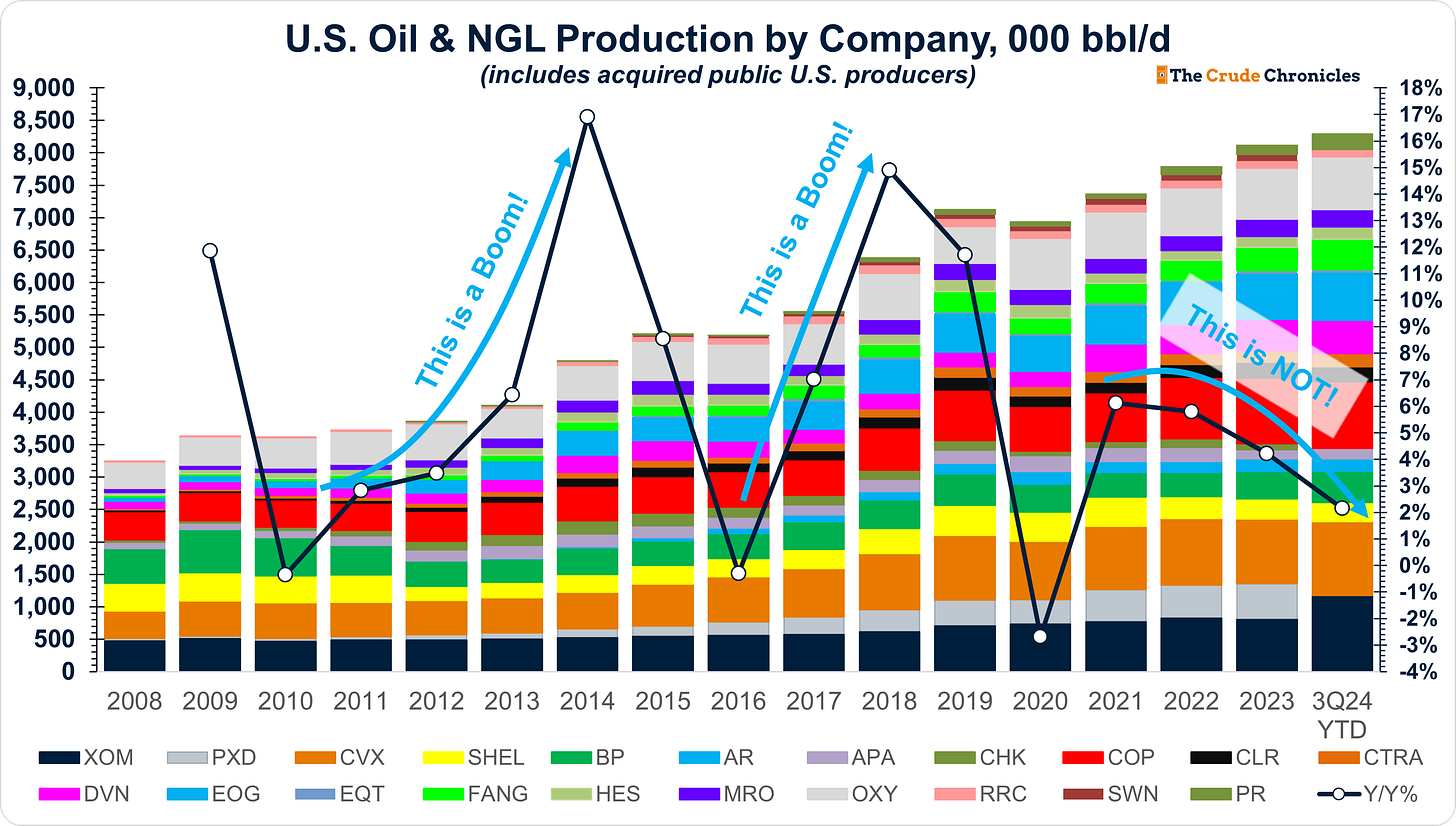

(1) Supply growth rates continue to decelerate. This is not the production boom of prior years.

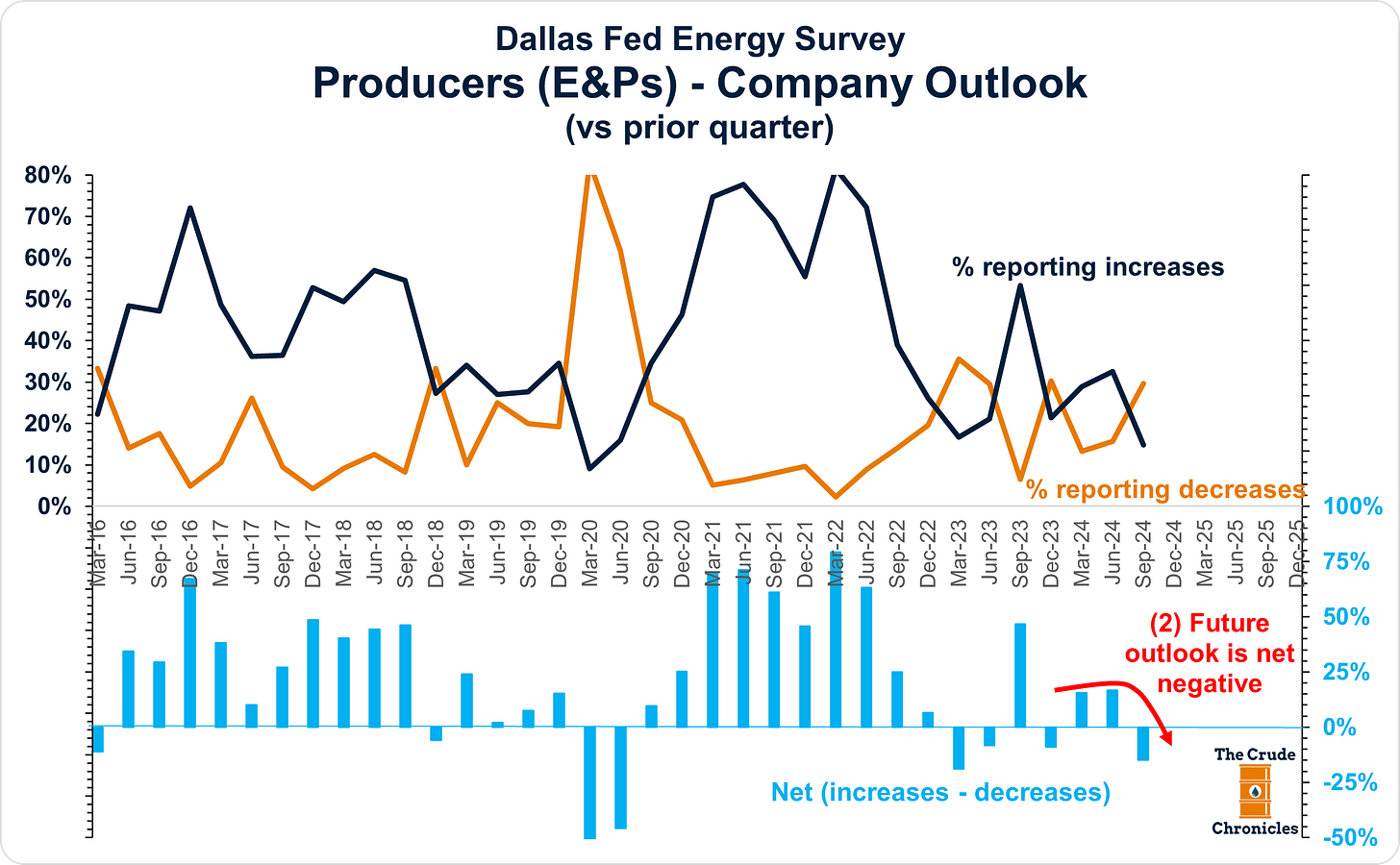

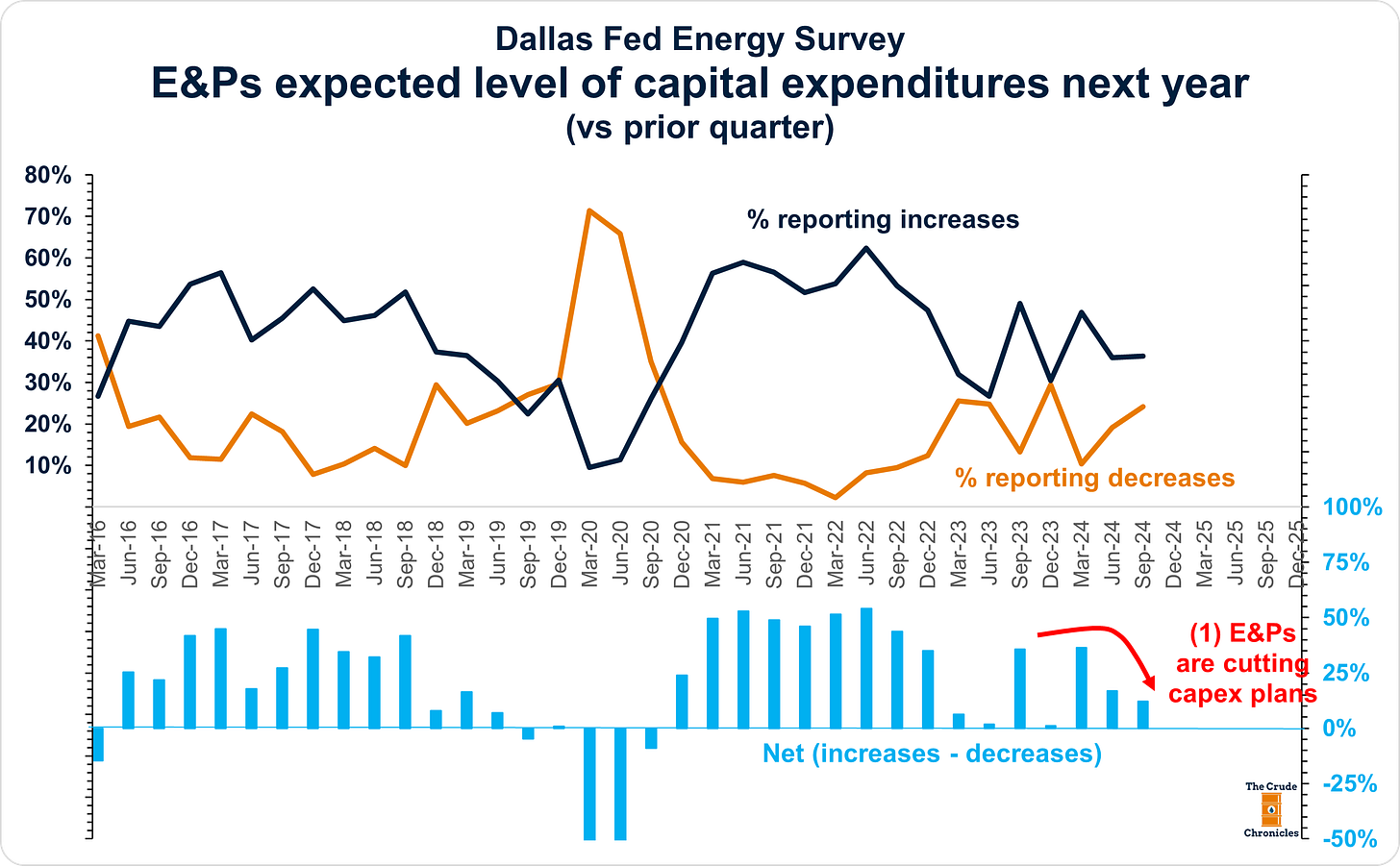

(2) Survey data on capex plans points to further deceleration as companies digest recent mergers coupled with lower prices.

The outlook for E&Ps has turned negative.

And E&Ps are cutting capex plans.

(3) In my opinion, the rig count has become less reliable as a predictive tool, so I focus on other indicators, like durable goods data, to gauge what's happening in the oil and gas sector.

Orders for new equipment continue to decline, and it's important to note the strong correlation with oil production as well!

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.