The Gist: (1) The trade off between share price leadership of XOM and CVX is driven by subtle differences in return on capital profiles. (2) Difference in returns on capital are primarily driven by (a) downstream exposure and (b) the upstream portfolios. (3) XOM & CVX have been replacing reserves while the cost (F&D) to do so is relatively low. The battle for Guyana, and thus Hess, is key for who wins the next decade of returns.

One of the first posts I ever wrote was the trade off between ExxonMobil and Chevron (HERE). We are going to revisit the relationship with some of the lessons that I learned over the years.

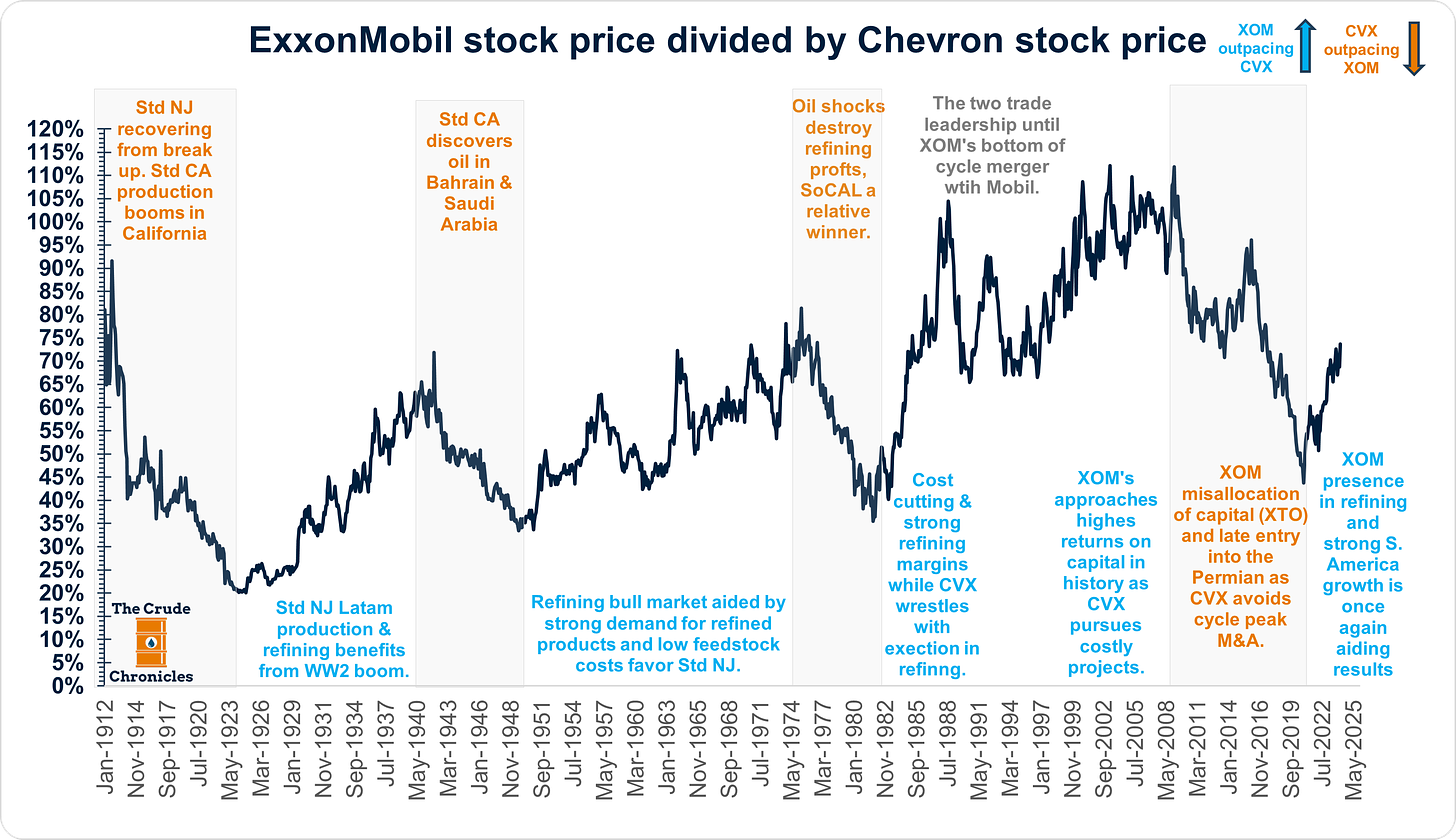

Let's jump into it with the first chart that takes ExxonMobil share price divided by Chevron share price since the breakup of Standard Oil.

When the line is rising, ExxonMobil is winning, and when it's falling, Chevron is winning.

There are two key themes that drive the tradeoff throughout history.

(1) Downstream refining.

(2) Upstream portfolio exposure.

For example, after the breakup of Standard Oil, ExxonMobil, or back then it was just Standard of NJ, was still licking its wounds and didn't have much upstream exposure.

Meanwhile, Standard of California (SoCAL) was freed from the management shackles of 26 Broadway and could grow production at a time when California oil & gas production was booming.

So Chevron won the first decade after the breakup.

During the war years, ExxonMobil’s Venezuela & S. America assets were heavily relied upon to feed the war effort coupled with their strong refining presence.

So they won the next few years.

Fast forward to the 2000s cycle, after the Mobil merger XOM delivered their highest returns on capital in history while Chevron was hampered by some costly LNG projects in Australia.

The tailwinds shifted back to Chevron after Exxon after the misallocation of capital that began with the XTO acquisition.

At the time, Exxon didn't have Permian exposure whereas Chevron did.

In addition, Chevron avoided some of those peak of cycle acquisitions.

However, since the 2020 bottom Exxon has been winning the race.

This shows up in the fundamentals. I put this beautiful chart together to bring home the point.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.