The Gist (1) Shareholder Value Add equation (SVA = ROCE - WACC) is the best long term valuation metric I have come across for Oilfield Service. (2) Upstream capital spending drives OFS returns on capital. We are in a recovery cycle so expect a larger reinvestment cycle in late 2020/early 2030. (3) SVA based methods are more reliable than profits based methods (P/E, EV/EBITDA, etc.) due to the volatility of profits.

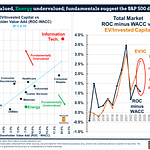

Let’s lead with the conclusion and the money chart of this post - EV/Capital Employed versus Shareholder Value Add is a great way to not only value the oilfield service industry but also see where we are in the cycle.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.