The Gist: Back in April, I was bearish oil (HERE). Now I sense a bullish disturbance in the force due to (1) recent strength in the global credit cycle (GM2) and possible top in the USD, (2) as EM demand (China) picks up, (3) U.S. supply surprises to the downside, all while (4) oil bounces off replacement costs.

Programming note: Starting next week, I will be on Christmas break. The kids (8 and 7 years old) still believe, so they will still receive presents from the Big Guy! I will be back in full effect on Friday, January 3rd. Feel free to reach out to me via email. I’ll be around. Wishing you a great holiday!

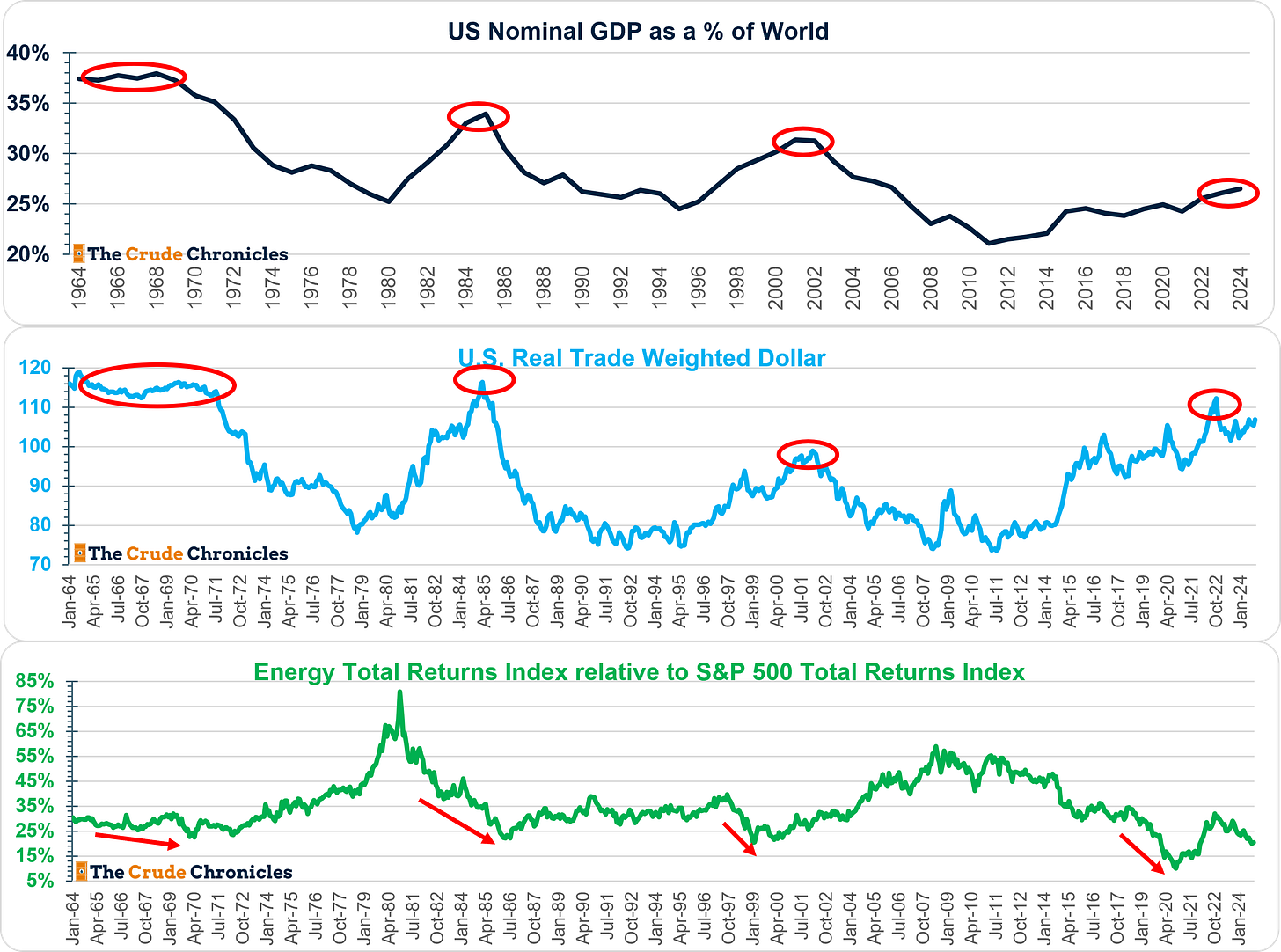

To paraphrase former Treasury Secretary John Connally, “the dollar is our currency, but it's (energy’s) problem.”

Nothing displays this more than the chart below.

Approximately every 20 years, the U.S. emerges as the focal point of global economic growth, drawing in worldwide capital flows, strengthening the dollar, and dampening growth in other regions. During these periods, energy producers tend to underperform compared to large-cap U.S. growth equities.

This may all be reversing, in my view. In this post, I present 4 reasons why.

(1) Recent strength in the global credit cycle (GM2) and possible top in the USD.

The dollar's momentum may be fading as positive economic surprises in the U.S. appear to have peaked, while the global credit cycle accelerates in other regions, as illustrated below.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.