The Gist: (1) Refining is a volatile sector but using my newly created Crude Chronicles Refining Index (CCRI) there are lessons we can learn. (2) The refiners are an early cycle FCF story but along the way they still follow cracks spreads barring any unforeseen events (mostly weather). (3) The equation ISM Order y/y minus EIA Total Petroleum Product Stocks y/y lead crack spreads by ~9 months. Refiners are already pricing in a more rosy scenario coming by 4Q24.

This week, we're going to try to make sense of refining stocks, and the conclusion I think is that refiners are already discounting a rosier 4Q24 outlook.

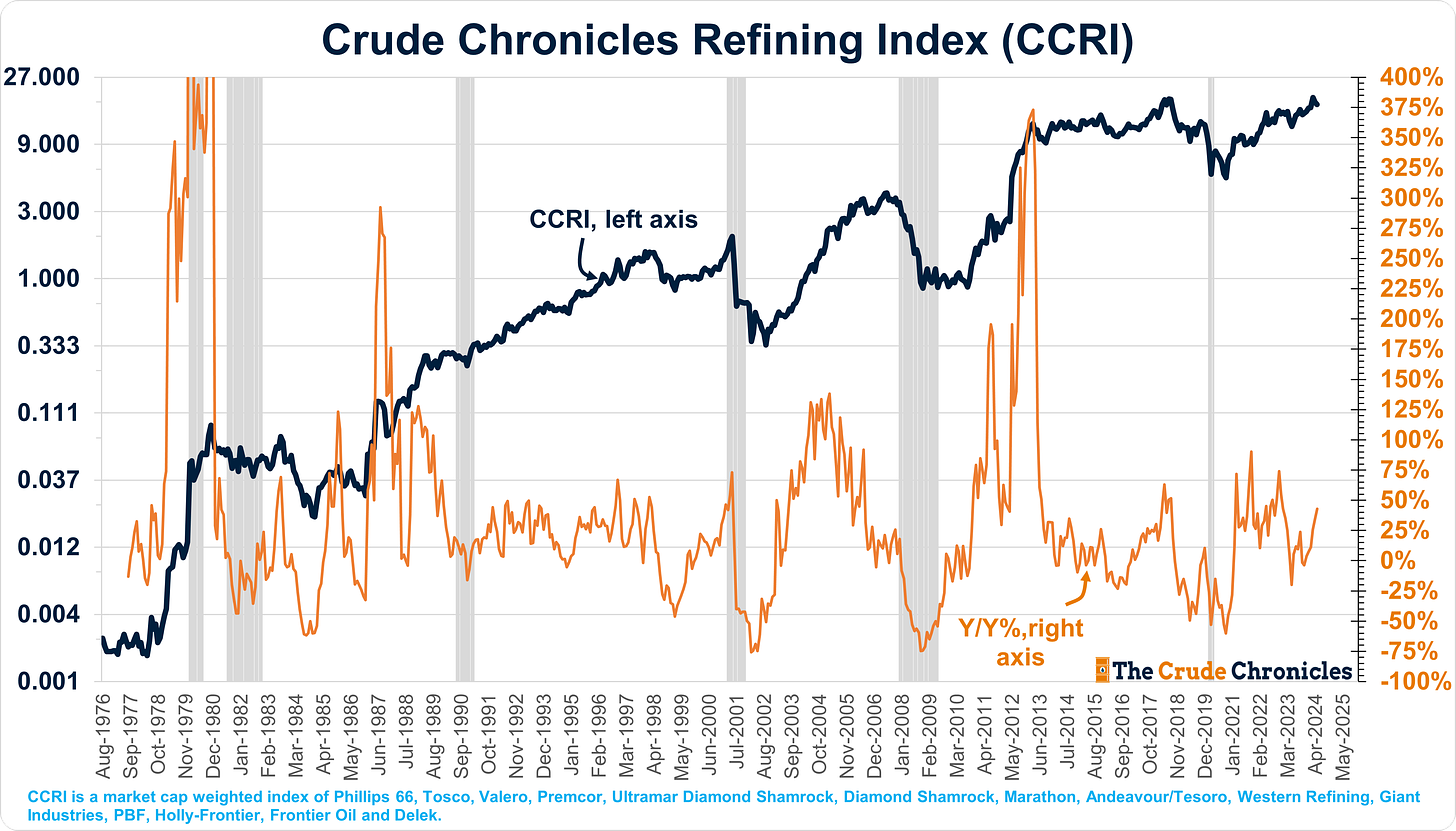

Let's jump into it with this first chart. I created this index, the Crude Chronicles Refining Index (CCRI).

Many of the refiners have been consolidated into the few refiners we know today, including the big three. However, before the consolidation occurred, there were numerous refiners, and we can use data from companies that no longer exist to apply to lessons today.

The overarching theme in refining is that it is an early-cycle free cash flow growth story. And I've attempted to illustrate that in this chart.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.