The Gist (1) Since the first quarter of 2023, energy’s multiple has nearly doubled despite a lackluster backdrop for oil and gas prices. Yet earnings will need to be in the driver's seat from here. (2) The U.S. energy bill, and thus profits, can double from here until it starts to impact productivity and GDP growth. (3) The earnings downturn that lasted from the 4Q22 (peak) to the 1Q24 (trough) goes back to a forgotten time when energy earnings were less volatile. We could be there again.

Welcome back, everyone. I updated my Crude Chronicles Energy Index after 1Q earnings season and let's jump right into.

(1) Since the first quarter of 2023, energy’s multiple has nearly doubled despite a lackluster backdrop for oil and gas prices. Yet earnings will need to be in the driver's seat from here.

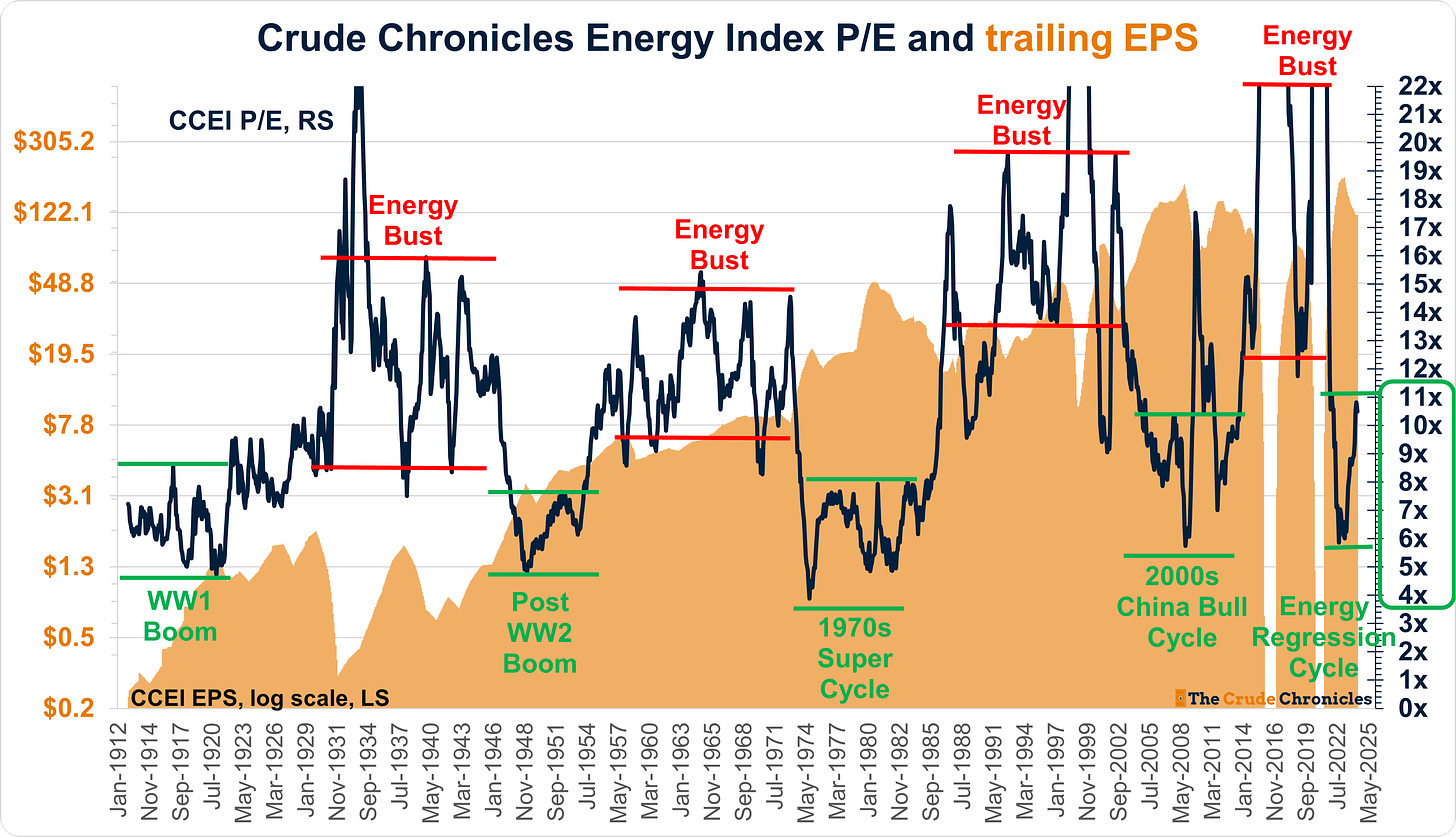

This is a chart you've probably seen before.

The point I want to get across is that the multiple has done the heavy lifting, and it's time for earnings to lead from here.

During energy booms, like the ones highlighted in green periods and the one I think we're presently in, P/E multiples tend to go to single digits and stay in this range. I added these red lines and the red text to highlight the periods when energy prices were low or during an energy bust, and these were times of high multiples.

So, the point is that you don't want high multiples in energy. For the cycle to have longevity and legs, we want to see earnings growth from here.

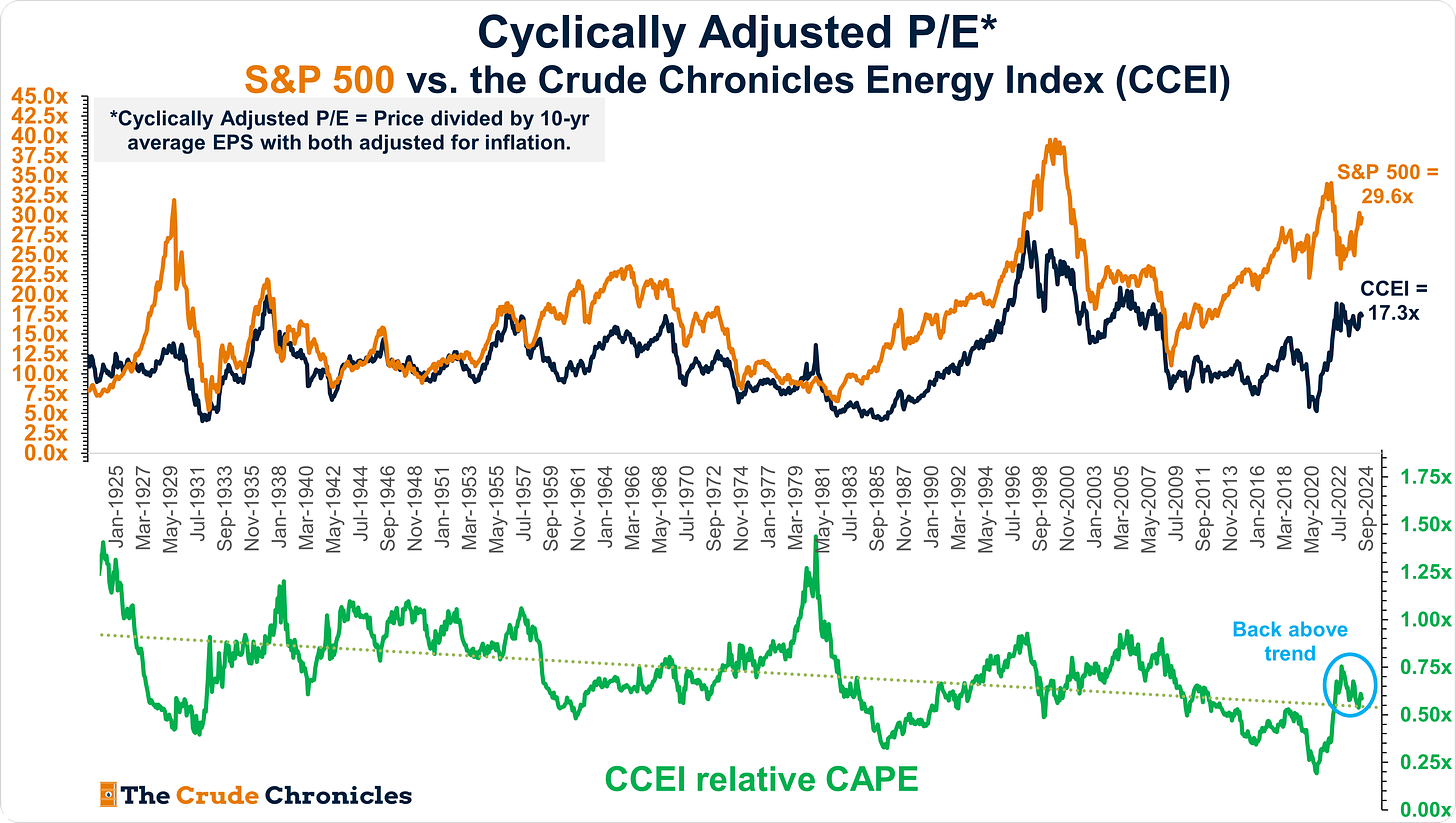

Staying on the concept of valuation for one more chart, another helpful tool to use is that of cyclically adjusted earnings, which was made famous by Shiller's work.

You can see both the S&P 500 (orange) and the Crude Chronicles Energy Index (blue) on the top.

Divide the blue line by the orange line, you get this relative multiple on the bottom (green line), or a relative CAPE, and voila, we're right back where we should be, right back on long-term trends since 1925.

(2) The U.S. energy bill, and thus profits, can double from here until it starts to impact productivity and GDP growth.

Skipping forward, profits need to be in the driver's seat from here.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.