Politicians soapbox about profits but pros watch returns on capital.

There are a few 6 sub-categories I put an oil & gas company into and they are the integrateds, E&Ps, oilfield services, drillers, refiners and midstream companies.

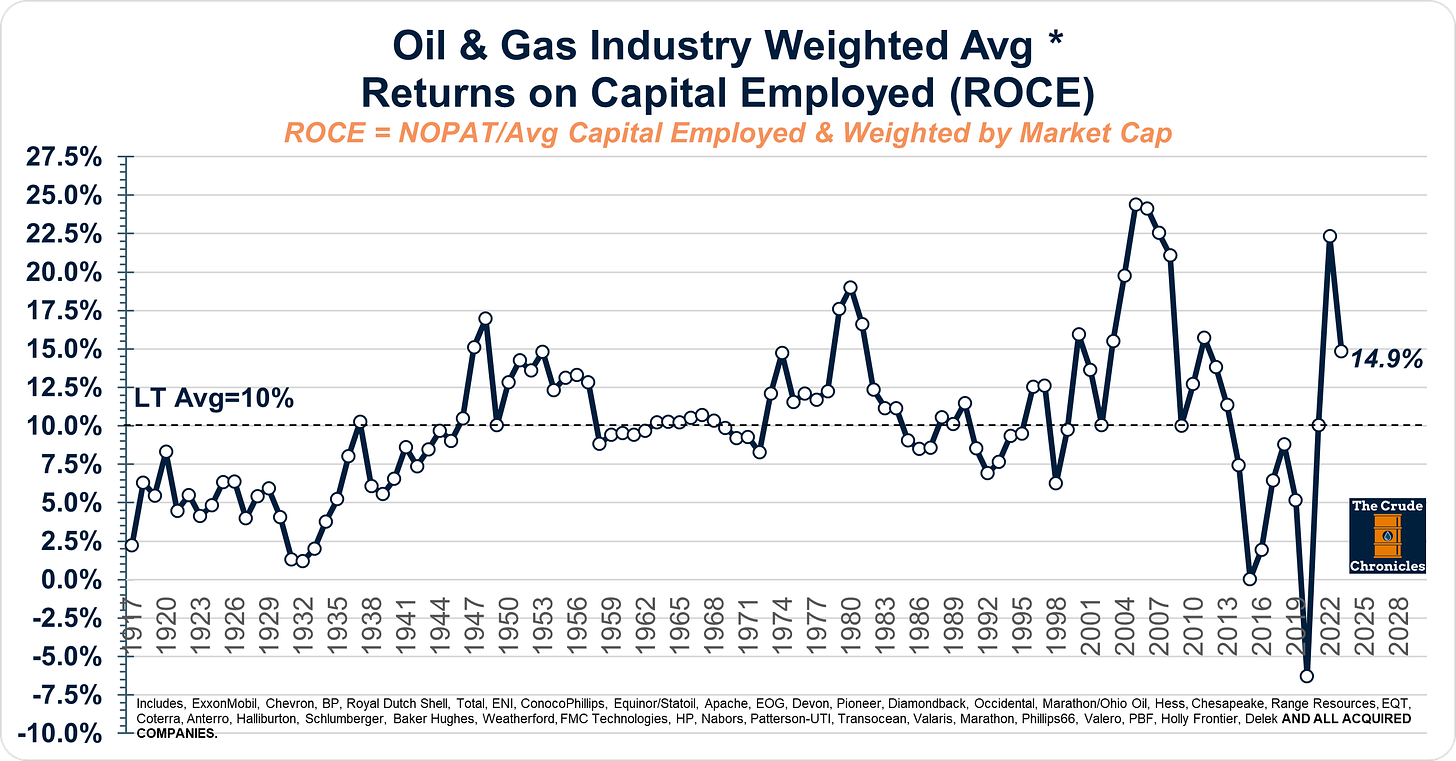

But no matter how you splice it they ALL gravitate around a 10% return on capital.

Chevron CEO, Mike Wirth knows what he is talking about when he says, “Through the cycle, it's an industry that generates 10%-ish returns” (HERE).

But it is my belief that the long-term average is somewhat meaningless in the world of cyclical.

You are either passing through it on the way to peak returns or coming back the other way on the way to trough returns.

Within those secular moves, you have these sort of waves for returns.

During a secular bull or super-cycle or whatever term you want to use for it, these waves tend to come in sets of 3. The same happens the other way.

Below I show this using return on equity because it is the only metric you can get for all the supermajors going back into antiquity.

You can continue to believe in the cycle after the first and second waves but NEVER come late to the party after that third peak.

If this theory is correct, 2022 will prove to be this cycle’s first of 3 waves.

The interesting thing about this ROE chart is the second peak is higher than the first and the third is higher than them all.

Within the context of history, 2022 was a VERY high ROE% so if there is to be a second and third peak, how high could they really go? Time will tell.

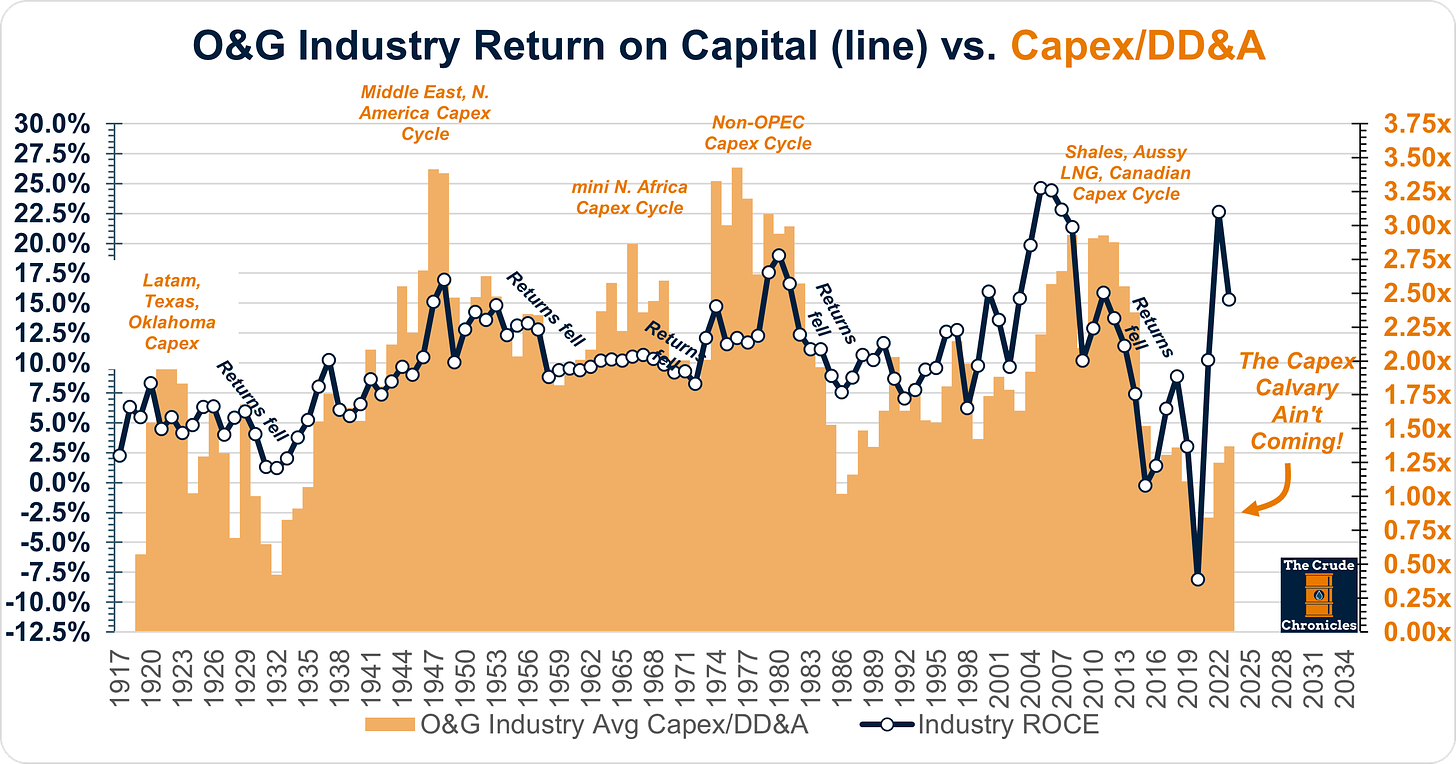

Saying “this time is different” will get a lot of doors slammed shut on you but one could argue that it may be the case given that capex is not responding to elevated returns like it has done so for 100+ years.

Last week’s post was a mid-year return on capital update for the integrated oils (HERE). This week we will attack the rest of the industry.

Updated charts for

E&Ps

Oilfield Service

Drillers

Refiners

Sorry, no midstream data yet - it’s on my bucket list of to-dos.

Let’s begin.

1H23 Returns on Capital for E&Ps

2022 was truly a remarkable year for the E&Ps, they did a record industry-weighted return of 30.4% but 1H23 saw a bit more modest levels at 18.0% as shown below.

Keep reading with a 7-day free trial

Subscribe to The Crude Chronicles to keep reading this post and get 7 days of free access to the full post archives.