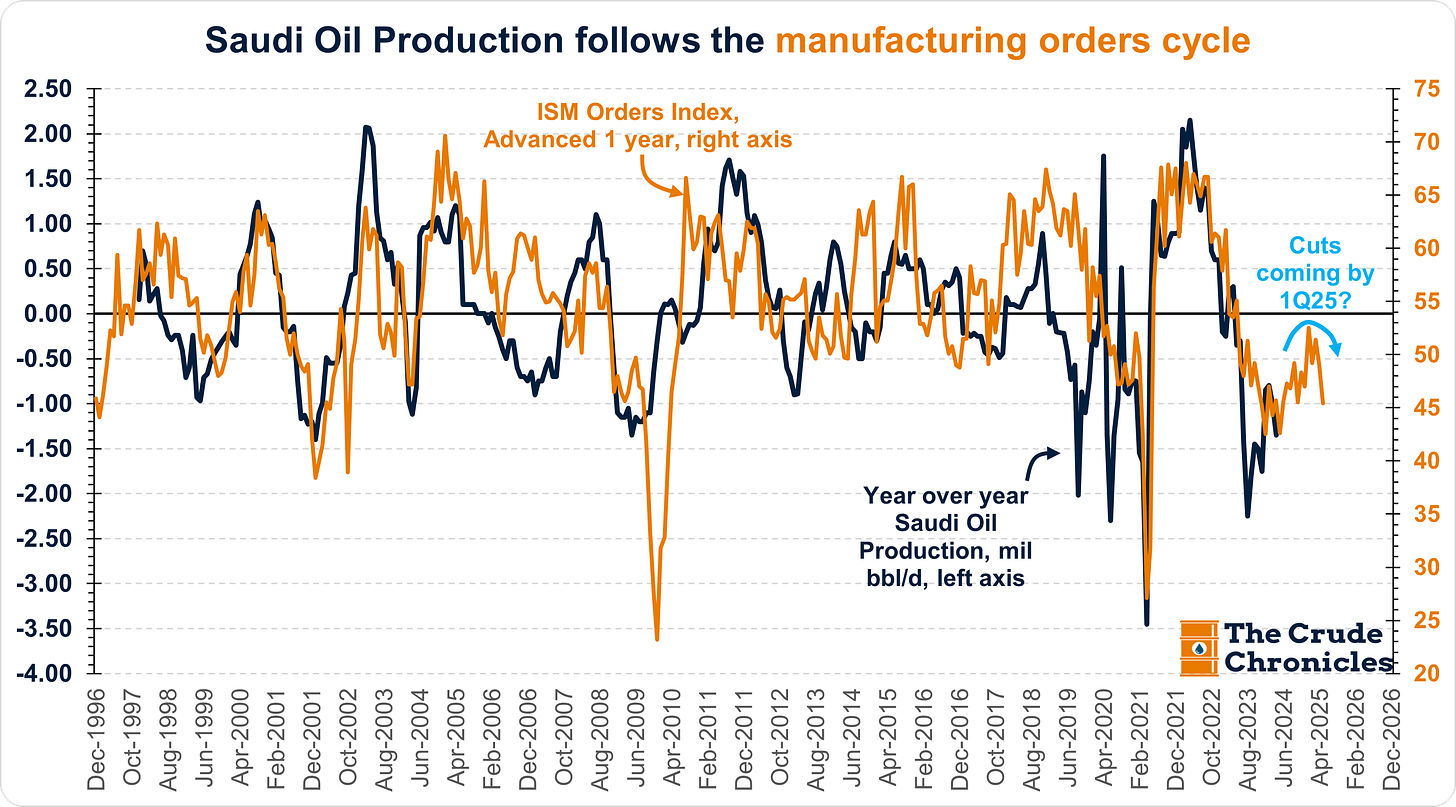

The Gist (1) Saudi production follows the manufacturing cycle with a 1 year lag, so an “OPEC+ Pivot” could occur by 1Q25. Saudi’s fiscal position is not as strong as 2014 so I don’t expect a price war. (2) Global money supply growth in USD (GM2) has been weak since January which has coincided or led pull backs in oil. This time is no different. (3) Follow the U.S consumer! Real wages growth is below the critical 2% growth barrier that drives oil demand. Bonus - the only chart worth watching.

Let's jump into it.

From this chart, there are two conclusions. The big one is that we could see a Saudi or OPEC pivot by 1Q25.

And why is that?

I've been following oil markets for a long time. One thing I've always noticed is that OPEC and Saudi Arabia make these decisions late in the cycle.

They always add supply in a late-cycle fashion at the end of a manufacturing expansion.

I show that above with the blue line, which represents Saudi Arabia's year-over-year oil production growth in millions of barrels.

The orange line is the ISM orders index advanced by one year.

In January of 2023, ISM orders started to bounce. Now, a little over a year later, Saudi Arabia is putting barrels back on the market or talking about putting barrels back on the market. Hmmm….

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.