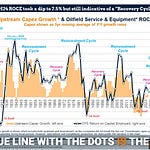

The Gist (1) 6-11x trailing P/E appears to be our “Multiple Range” for this cycle and history shows most of the earnings drawdown may be behind us. (2) ExxonMobil is back to an energy weighting it hasn’t experienced since prior to the GFC and the failed XTO acquisition. (3) Energy continues to punch below it’s weighting in corporate U.S. profits. Howeve…

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.