The Gist: (1) XOM is making an all-time high in nominal terms, but in inflation-adjusted terms, XOM shares are still 12% below their Sep-07 peak. However, they continue to test 17 years of resistance. (2) XOM remains 31% below its Sep-07 real market cap peak. Speaking of market cap, the market cap-to-GDP ratio suggests real total returns per annum of 6-7% for the next decade. (3) XOM’s EPS drawdown since 1912 suggests a potential bottom soon, which is key for market outperformance. A recovery is necessary for outperformance relative to the market.

What's up, everyone? Rob here with the Crude Chronicles. It’s been a tough couple of months in the energy patch, and the phrases 'oil and gas' and 'all-time highs' aren’t mentioned together too often these days.

There aren’t too many energy stocks out there making new all-time highs.

One name where they are is with ExxonMobil.

However, in inflation-adjusted terms, XOM is still 12% below its all-time high, which was established at the end of September 2007. So, still a little ways to go.

I think that’s the real metric to focus on (pun slightly intended). If you look at the right side of the chart, we’ve been testing long-held resistance more frequently as of late.

The long term analysis is basically the limit of my technical analysis skills — but I also notice that XOM likes to trend for decades.

The trend has clearly been bearish since the 3Q07 peaks, but that’s why I’m watching closely, waiting for a potential breakout. Maybe we’ll see another multi-decade trend emerge.

In terms of market cap, it’s still well below its inflation-adjusted market cap from September 2007, which was three-quarters of a trillion dollars, or $752 billion back then.

Skipping forward, it’s important to focus on market cap.

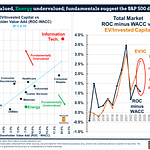

I’ve found that, historically speaking, XOM’s market cap relative to GDP has been the best predictor of what real total returns per annum will be over the next decade.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.