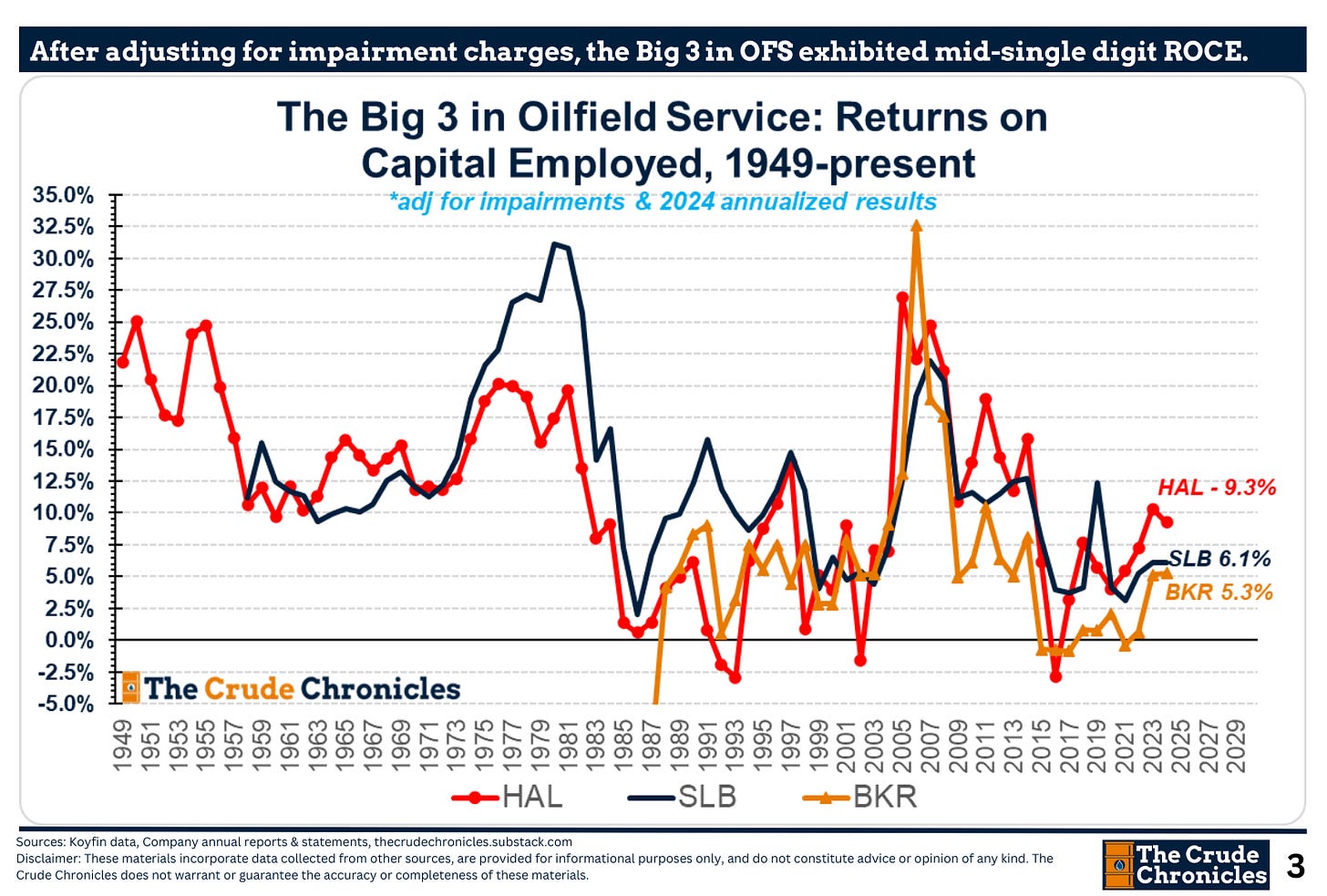

The Gist (1) The oilfield service industry delivered mid-single-digit returns on capital employed for 1H24, in line with the “recovery cycle” view. (2) Relative pricing power shows gross margins may be leveling out as EBIT/operating margins are ticking down. (3) Capex remains low with balance sheets fully recovered.

Programming Note: I will be out of pocket for Labor Day weekend. The Crude Chronicles will return to your inbox on Friday, September 6th. Have a great weekend, and see you then!

Welcome back, everyone. Over the last couple of weeks, I've been providing my mid-year return on capital (ROCE) recap reports. Today, it's time for the oil field service (OFS) names.

I know it's a bit late, but I wanted to get the Integrateds (HERE), E&Ps (HERE), and Canadian (HERE) return on capital reports out before doing the oil field service recaps, even though OFS was the first to report.

After adjusting for impairments, the sector is exhibiting mid-single-digit returns on capital, which is much lower than what they're reporting on a GAAP basis.

It's very important to do this for the oil field service industry because they took more impairments relative to the size of their balance sheets than any other sector.

If you have any questions about the calculations and you're a paying subscriber, please feel free to shoot me an email. I'll show you the exact line items I'm using in the P&Ls and the balance sheets to calculate this, as well as the adjustments.

Among the Big 3, Halliburton is leading the pack, SLB is in the middle with Baker Hughes lagging. For a view of the mid-cap companies, which I define as those with market caps between $7 billion and $16 billion, we have Tenaris, FTI, Weatherford, and NOV. You can see their returns on capital here on the left, and the smaller oil field service companies over here on the right.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.