The Gist (1) Chevron vs. the S&P 500 bottoms at 3% and peaks at 9%. It is currently at the low end of this range. Historically, this level has marked a bottom, coinciding with a potential trough in EPS as well. (2) Since the COVID lows, ExxonMobil has been the clear leader; however, it’s worth noting that Chevron is steadily closing the ROCE gap. (3) Recycle Ratios lead Returns on Capital Employed (ROCE), and Chevron boasts one of the highest Recycle Ratios thanks to its industry-leading F&D. Finally, there is optionality on Hess.

To paraphrase MTV back when they used to play music videos, get out there and ‘Rock the Vote’ today.

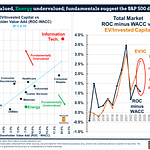

I was updating this chart for Chevron’s latest 3Q24 earnings report.

This really caught my attention because it is not too often that one finds Chevron trading at these levels relative to the S&P 500.

In this chart, the orange line represents Chevron's share price divided by the S&P 500, while the blue line represents the same ratio using earnings per share.

If you knew nothing about the company but had some knowledge of oil and its history, and I asked whether you’d go long Chevron if the dates were September 1912, November 1940, April 1970, January 1999, and October 2020, you’d likely say yes.

That’s because since the breakup of Standard Oil, CVX vs. SPX bottoms at ~3% and peaks around 9%. Currently, it's at 2.61% of the S&P 500.

This drop is largely due to short positions related to uncertainty around the Hess acquisition and recent operational issues. However, I believe these factors are minor compared to the broader macro backdrops that surrounded the dates highlighted in the above chart.

That said, I need to temper my enthusiasm from the previous chart somewhat, as Chevron should be evaluated on a total returns basis.

Many CVX shareholders benchmark against the S&P 500.

That’s why I’m comparing the two in this chart.

The dark blue line at the top shows the S&P 500’s 10-year real total returns per annum, which, over the past decade, has averaged about 9.7% per year, including price appreciation and reinvested dividends.

Chevron, by comparison, has averaged only about 4.2%. The difference between these two lines, shown on the bottom, is approximately -5.5% per annum.

With the 3Q24 report, it’s interesting to note that the bottom blue line is bouncing off what I call a ‘one-sigma event,’ comparable to only four other dates in history.

August 2021 marked a 'two-sigma event' for Chevron, when its relative real total returns bounced off levels last seen in the depths of the Great Depression (April 1931).

However, for Chevron to gain ground, it’s crucial for earnings to establish a floor here.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.