The Gist (1) Investors often view HAL and SLB as international versus domestic plays, but the correct approach is to evaluate which company can create more SVA (Shareholder Value Added). (2) Halliburton and SLB both face a high cost of capital, and their returns on capital (ROCE, adjusted for impairments) have yet to exceed this hurdle rate. (3) HAL incentivizes ROCE more than SLB. If incentives drive outcomes, then by this logic, HAL could achieve positive SVA faster.

We're going to start off with a chart of how we've all been conditioned to think of SLB vs. HAL which is in terms of domestic versus international exposure.

But I think the relationship there has been very, very spotty at best and may not be the correct way to look at these .

On the left, I show SLB and Halliburton's revenue mix going back to the early seventies. For obvious reasons, Schlumberger is the international play, while Halliburton is more exposed to the domestic market.

On the right, however, that relationship is not necessarily borne out when you look at where rig counts are growing faster.

The blue line represents Halliburton's stock divided by SLB's stock. The orange line, on the other hand, shows the U.S. rig count versus the international rig count.

One would expect, based on the relationship, that when the blue line is also rising, U.S. rigs are outpacing the international rig market and thus HAL is beating SLB.

However, this relationship has been quite spotty and inconsistent in terms of its correlation between relative outperformance between the two names.

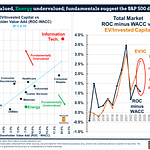

The correct way to evaluate these two stocks is by determining which company can create more shareholder value. First, let me clarify how I define shareholder value—it's a term that gets thrown around a lot. But at its core, in its purest form, it’s simply the returns on capital minus the cost of capital.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.