The Gist: (1) Returns on capital (ROC) in excess of the cost of capital show that the Tech sector is overvalued and Energy undervalued. It also implies the S&P 500 could drop to 4,700 should this persist.

(2) Big Oil rewards returns on capital with shareholder-friendly incentives, while Big Tech lacks such alignment, with many incentives unrelated to financial performance.

(3) ROC is now relevant for Big Tech as the industry has grown more capital-intensive. Shareholders dislike capex on lower-return projects that diminish overall shareholder returns. ie XOM & MSFT.

(4) O&G Market Cap as a % of GDP points to real returns of 9-10% per annum for the next decade, beating the S&P 500, in my view.

What's up everyone. Rob here with the Crude Chronicles. Happy New Year. I got an awesome piece today!

Let's jump right in!

Every year, Professor Damodaran of NYU (HERE) does a massive data dump on over 8,000 companies. What I do is true up all that data to the 11 S&P sector levels.

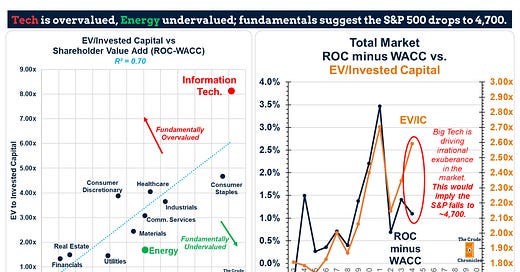

What we find here is that tech is vastly overvalued and energy is vastly undervalued. If this persists, the S&P 500 could drop to as low as 4,700.

The market could possibly be in the process of doing that as we speak with the weak performance in the market since December.

The scatter plot on the left shows on the X axis, we have shareholder value add, which is returns on capital minus the cost of capital.

That drives the Y-axis of valuations or EV to invested capital.

If a sector is able to earn more on their capital base than what it costs that sector will get a higher multiple because they are creating value.

And vice versa

It has a good R-squared of about 0.70x. Energy is way below the trend line, and tech is above it.

I'm not saying tech doesn't create value. I'm saying the multiples they are assigned are significantly higher than fundamentals suggest, and on the right chart, we see the effect it is having on the market as a whole.

However, there is a wide gap between the two, and this irrational exuberance could imply the S&P 500 falls to 4,700 if valuations fall back to fundamentals.

How has this happened?

Simply examine the incentive structures that have been in place for this to occur.

The point I make in this next slide is that big oil has a much more shareholder-friendly compensation structure than big tech.

The main point here is there are zero incentives in place to regulate growth in the land of big tech and protect returns on capital.

If you've been following my work for a long time, you know I am a firm believer that returns on capital drive the oil and gas sector over the long run because it is a very capital-intensive industry.

At the top, I show the factors that drive annual incentives for six major oil & gas companies and two oilfield service companies. On the right, we have long-term incentive performance factors within performance share units which are a large component of compensation received by named executive officers every year.

The incentive structures for these oil & gas companies are aligned with shareholders interests because they align with what drives shareholder returns - returns on capital.

The bottom half examines big tech's annual bonus and long-term incentive structures. It actually blew my mind with what's going on in big tech.

None, absolutely none, of the annual cash incentives or the long-term incentives have any relation to returns on capital at all.

In fact, many of these factors—I don't even know where they come from. Many are not related to financial performance. For example, Meta's "build awesome things".

What are awesome things? Oil & gas builds awesome things! Ever seen an FPSO or a self-automated drilling rig that can walk? Or the ability to drill two miles down and four miles across to hit source rock with pinpoint accuracy? Pretty awesome!

How can shareholders understand that? Or societal issues related to Meta?

Don’t believe me, go look this up in their proxies (HERE).

It just blew my mind. Amazon had no disclosures around annual bonuses, and Google's ESG factors—okay, how does that relate to profits, profit growth, or returns on capital growth? Not all of them are guilty.

Microsoft has revenue-based factors but the tech bellwether threw me for a loop. A portion of their long-term incentives based performance share awards is based on LinkedIn visits.

It reminds me of the late nineties when companies were awarded high valuations for clicks on their websites.

Companies such as Amazon and Meta only award very long-term restricted stock units that vest five to ten years out in some cases.

While this is supposed to align management with shareholders in creating value over the long run, it also entrenches managements in what can be poor strategies, which I believe is actually occurring.

You could get away with this sort of incentive structure because big tech was never that capital-intensive. All that mattered was revenue and profit growth but that has all changed as of late.

We can see in these next slide that Tech is no longer the asset-light model it was ten years ago. On the right, it's the most investment-intensive industry among the 11 S&P 500 sector.

Energy has grown to be one of the least capital-intensive sectors of the S&P 500.

You've probably seen this chart from me before—energy's capital spending versus major tech company capital spending.

Tech is approaching $400 billion in capex based on consensus estimates out to 2027, far surpassing the peak that Western shareholder-owned energy companies rose to in 2014 before prominent figures in the investment community (HERE) forced these oil & gas companies to take the "The Pledge" and adopt more shareholder-friendly incentive structures, focused on returns.

I break down the equation in this next chart showing returns on capital versus the cost of capital. Energy is on the left, tech is on the right.

We can see that from '08 to '20, incremental returns on capital in the energy sector were making lower highs to a point where they were destroying value (returns on capital < the cost of capital).

I believe that made a generational bottom in 2020. Returns are protected for the long run because managements are focused.

That's not the case with tech on the right.

Returns on capital are below 2013-2014 levels, but they are also starting to make lower highs as well. They're below their 2022 levels, despite the fact that they're getting valuations approaching 2022 levels.

Shareholders really dislike capital spending on incrementally lower return projects, i.e., AI, rather than returning to shareholders. We learned this with Exxon, I think the tech sector may learn this with Microsoft.

We can see here on the left from '08 to '20, capital spending far surpassed returns to shareholders (repurchases and dividends). XOM had to cut the repo program to fund these lower return projects and shareholders revolted with XOM vastly underperforming the market.

Well, guess what?

It looks like Microsoft and may be repeating this mistake of being in “No Man's Land” or capital spending greater than returns to shareholders because they are investing in lower return projects.

What does this all mean? I think real returns in energy are going to be strong in the neighborhood of 9% to 10% per annum for the next decade and beating not only big tech but the market as well!

I hope you liked this one!

This post is meant to send some shockwaves out there, but please provide any comments or feedback below or simply hit reply to the email, and I'll talk to everyone next time.

-Rob Connors, CFA, CPA, “No Man’s Land” Survivor

Print Version

Disclosure & Terms of Use

Nothing in this content should be considered personalized financial advice or a solicitation to buy or sell any securities.

The content provided here is for informational purposes only. You should not construe any information or other material as investment, financial, tax, or other advice. The views expressed by The Crude Chronicles LLC are solely their own. Nothing in this content constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in any jurisdiction. An investment in any financial instrument involves risks. Some or all the securities discussed may not be suitable for you. Please consult your own investment or financial advisor for advice related to all investment decisions.

Terms of Use: Paying subscribers are permitted to use these charts for their own use (i.e. sharing internally or within published research to external clients) provided proper sourcing is used. Please source as "thecrudechronicles.substack.com"