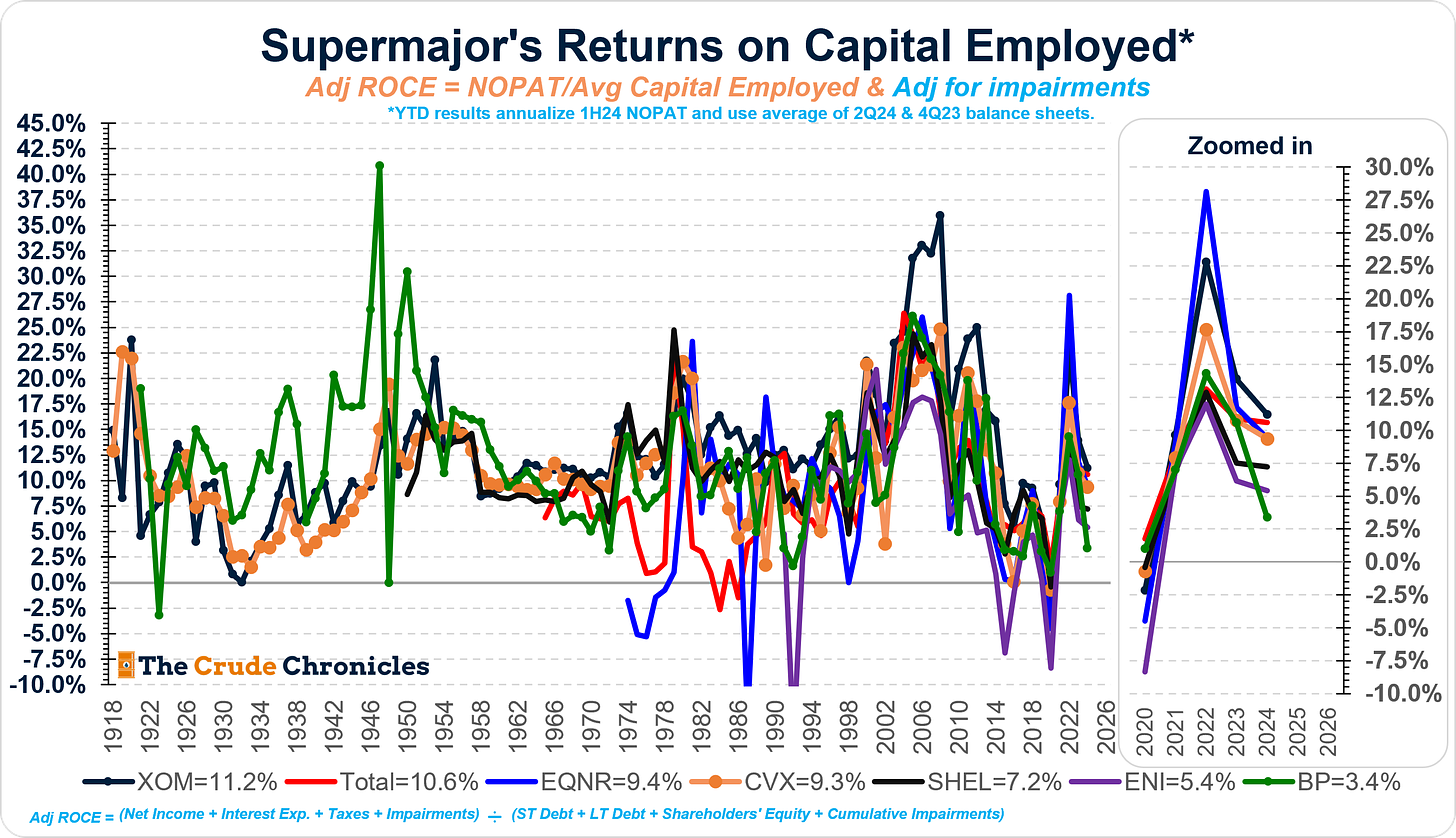

The Gist: (1) The integrated oils delivered a 2024 YTD ROCE of 9.3% slightly below the long term average of 10% with Exxon leading the way and BP continuing to fall behind. (2) Finding, development, and acquisition costs and capital spending remain low so future returns on capital should remain strong. (3) The next phase of the returns cycle (ROCE/ROE/etc) will be the move from “Doubt” to “Optimism.” Stay Tuned.

Welcome back everyone!

All the big oils have reported 2Q results and what I like to do at this point in the year is take a look at annualized first half results to get a sense of where we are in the cycle.

We can see from the above chart, ExxonMobil continues to lead the way with about a 11.2% returns on capital and BP continues to lag at about 3.4% with the rest of them bunched up there in the middle.

These numbers are different than what the companies report because I adjust for prior years’ impairment charges. In the fine print of the chart you will find the calculation I use.

The way the accounting works is during bear market for commodities such as 2008- 2020, these companies wrote off a lot of assets and goodwill but with energy prices having recovered, they are not asked to now add them back to the balance sheet.

If we were to take that previous chart and market cap, weight it, then you get a chart that looks like the following.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.