My 4Q24 Chart Deck (at bottom, below the paywall) is out and as always it is a chart packed adventure.

Here are the three main points.

In 3Q24, the report titled “Transitioning from “Doubt” to “Optimism - We just may have to go through a recession to get there HERE)” laid out the view that energy would see a pull back but it was needed in order to transition from the “Doubt” phase of the cycle to the “Optimism” phase. This is playing out as expected. Negative sentiment around oil & gas is pretty close to baked in, in my view.

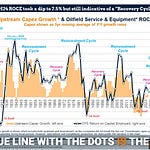

Valuations & capex trends tell me 2022 was not another 1991, which led to another 7 years of relative underperformance for the energy sector. Instead, it is more akin to 2001, a period where the following 7 years favored oil/energy over the S&P 500.

Over the past 200 years, excessive money creation by governments has been the fundamental driver of commodity inflation cycles, including oil. The median voter shows little concern for their government's spending habits, so the fiscal deluge is likely to continue.

Shales do NOT need to peak. Well productivity growth needs to slow for producers to drive development costs and oil prices higher

Below is a preview of the topics discussed

For paying subscribers, the chart pack is below and the video is an overview.

Listen to this episode with a 7-day free trial

Subscribe to The Crude Chronicles to listen to this post and get 7 days of free access to the full post archives.